Saturday, April 30, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

At this point, I now realized that there would certainly be a hearing that would deal with two issues - the employer's many applications to reopen and whether the claimant was engaged in misconduct. But I knew I also had to concentrate on the former issue - the right to reopen - and I needed to ascertain what documents were filed and when, how the service representatives were changed, their reasons for defaulting, etc. and so a new thorough review of the file began.

Friday, April 29, 2011

ON FORECLOSURES

No. 616 April 2011

"RULE-MAKING POWER OF OFFICE OF COURT ADMINISTRATION IS CONTESTED

OCA’s Recently Adopted “Affirmation” Rule Held Invalid

On October 20, 2010, Chief Judge Lippman announced the promulgation of the “affirmation” rule applicable in actions to foreclose mortgages on residential properties. The rule requires that the plaintiff’s papers include an affirmation by the plaintiff’s lawyer attesting to the papers’ integrity. There have since been several cases on the rule. One of them, Citibank, N.A. v. Murillo, 30 Misc.3d 934, 915 N.Y.S.2d 461 (Sup.Ct., Kings County), shows what many would consider a draconian consequence for violating the rule: a dismissal of the action “with prejudice”. (With prejudice?)

That case came down on January 7, 2011. Even more recently, on Feb. 28, 2011, comes LaSalle Bank v. Pace, 2011 WL 723555 (Whelan, J.), from the supreme court in Suffolk County, not only refusing to apply the affirmation rule, but holding that its very promulgation is beyond the powers of its promulgator: the Office of Court Administration, i.e., the chief judge and his appointee, the chief administrative judge.

In LaSalle, the mortgagee (plaintiff P) moved for summary judgment. The mortgagor (defendant D) resisted it, relying on the ground that the motion did not include the required affirmation. The court held the reliance misplaced. It then reviewed D’s defenses and counterclaims on the merits, found them baseless, granted P’s motion for judgment, and appointed a referee to conduct the foreclosure.

After considering at length the constitutional and statutory provisions relating to court administration, the court in LaSalle concluded that

Since [the] rule making authority cannot significantly affect the legal relationship between litigating parties, the imposition of additional matters [like the affirmation requirement involved here] that impair statutory remedies or enlarge or abridge rights conferred by statute are not the proper subjects of rules promulgated by court administrators.

As we see it, the issue boils down to whether this affirmation rule can fairly be considered an “administrative” matter. The court in LaSalle thinks not; the Office of Court Administration obviously thinks otherwise.

The court says the effect of the affirmation rule is to “impair the statutory remedy of foreclosure”, seeing evidence of this “in the recent, vast reduction in case filings and the resounding halt in the prosecution of foreclosure actions pending in this court that immediately followed” adoption of the rule. (Of course the “halt” is only temporary, pending correction in each case through belated submission of a lawyer’s affirmation.)

Incessant complaints by foreclosure defendants and their representatives about the condition of the proof offered in behalf of foreclosing mortgagees is what led to the rule. The mortgage realm has been the scene in recent years of numerous assignments, and with the economic turndown that made it impossible for many homeowners to pay their mortgages, foreclosures piled up and the offices of the foreclosure attorneys, whether independent or in-house, often couldn’t, or in any event didn’t, submit the proper paperwork. There was often evidence of attestations of ownership (of the mortgage) made by those without the requisite knowledge, and sometimes even the suggestion of perjury as those without knowledge swore to things they didn’t know.

The rule was designed to relieve this chaotic scene by securing in each case the affirmation of a lawyer who, before affirming, would have to go through the papers and make sure things were in order, including, especially, checking out the ownership links that connected the foreclosing plaintiff with the original mortgagee.

The immediate question here is whether, considering the circumstances, the requirement of the affirmation is a reasonable exercise of administrative power in the operation of the courts. The LaSalle case says it’s not; that it’s an impermissible exercise of a legislative power. Those on the other side say in response that the power to make rules is itself a species of legislative power, and that if either the constitution or the legislature, or a combination of them, confers the rule-making power on the courts’ administrators, they are in essence directing a sharing of this “legislative” power with those administrators.

That boils the issue down further. Does this particular rule-making exercise cross the line beyond which the sharing stops? The LaSalle court thinks so. The Office of Court Administration does not. We’ll have to await appellate court input on that.

The rule-making power conferred on the court system is no small thing. It accounts, for example, for all the Uniform Rules that fill two McKinney’s soft-covered books, each more than an inch thick and recompiled annually. Playing the devil’s advocate, we might juxtapose the affirmation rule with each of the innumerable subjects addressed in those rules and then ask whether the affirmation rule emerges as all that much of an outlier. The rule seems no more a trespass on legislative prerogative than many parts of (for example) the many-parted Uniform Rule 202.5, which in supreme and county court governs “Papers Filed in Court”.

And what about the “halt in the prosecution of foreclosure actions” that the LaSalle court says the affirmation rule has brought about? Would it be better to leave the issue of the propriety of the papers in each case to individual motion by each individual defendant? Would hundreds or perhaps thousands of motions do better than one rule that clears the decks of all the cases for the brief time it takes each plaintiff’s lawyer to reexamine the papers in each case, fill in what’s missing, and then “affirm” that all is now well? Doesn’t that make for a smoother running of the courts than requiring each judge in each case to go through unaffirmed papers and do the weeding out that the rule just wants the plaintiff’s lawyer to undertake to spare the courts the burden?

An irresistible analogy occurs to us here. Back in the 1960s, the situation commonly referred to as “sewer service” reached epidemic proportions. (Ironically, it has recently reached that level again. See Siegel’s Practice Review 208:1.) It led to the 1973 enactment of a provision – now subdivision (c) of CPLR 5015 – that authorized an en masse vacatur of fraudulently secured default judgments, not on application by each victimized defendant, but with a single proceeding by an administrative judge. (See Siegel, New York Practice 4th Ed. §§ 71, 293.) The practice avoided a huge number of individual motions, essentially an administrative accomplishment, and in fact, before the legislature got around to codifying the practice, it was done without any legislation at all.

The affirmation rule at issue here seems to us even less intrusive into legislative powers. It merely requires plaintiffs’ attorneys to review papers in advance of court submission so as to assure that if a defendant does default, the default will not be undone for paper defects avoidable by requiring an attorney’s affirmation that the papers are in order. The requirement is designed, not to dispose of each case on its merits, but to aid the court in considering its merits – an attainment almost classically categorizable as “administrative” and the kind of effort one would expect from those charged with running the courts."

Labels:

Mortgage Foreclosure

Thursday, April 28, 2011

NYS EDUCATION LAW - CHILD DOES NOT LIVE IN SCHOOL DISTRICT

This was in a series of earlier blogs but the following news story will illustrate what how far some school districts will go:

A homeless woman from Bridgeport who enrolled her 6-year-old son at a Norwalk elementary school has become the first in the city to be charged with stealing more than $15,000 for the cost of her child's education.

A homeless woman from Bridgeport who enrolled her 6-year-old son at a Norwalk elementary school has become the first in the city to be charged with stealing more than $15,000 for the cost of her child's education.

Wednesday, April 27, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

When the claimant arrived, I advised the claimant of what I found in the file and that it would appear that the ALJ will adjourn the case. And shortly thereafter, this is exactly what happened: the ALJ came in to the waiting room and advised us that because the notice was sent out to the employer's first service representative and not the employer's new service representative, the hearing will be adjourned.

This was the third time the claimant had to appear at a hearing in which the employer did not show up. This was my second time.

This was the third time the claimant had to appear at a hearing in which the employer did not show up. This was my second time.

Tuesday, April 26, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

I appeared at the hearing office on October 5, 2010 at 9am. I asked to review the file again because, as stated in the prior post, I was unsure as to why the first employer service representative was still listed on the latest notice of hearing after being advised that the application to reopen was being made by a new employer service representative.

In reviewing the file, there was a fax request made the day before by the new employer service representative for an adjournment on the grounds that they were not properly notified.

In reviewing the file, there was a fax request made the day before by the new employer service representative for an adjournment on the grounds that they were not properly notified.

Monday, April 25, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

I confirmed with the claimant that we would meet on October 5, 2010 at 9am, an hour before the third scheduled hearing at the Garden City Hearing Office. However, I was still unsure as to why the first employer service representative was still listed on the latest notice of hearing after being advised that the application to reopen was being made by a new employer service representative.

Sunday, April 24, 2011

Saturday, April 23, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

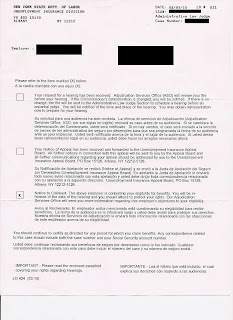

Here is the next page of the notice. As you can see, the notice is quite similar to the Notice of Hearing mailed on July 12, 2010.

Friday, April 22, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

The Notice of Hearing sent out on September 27, 2010 still lists the first service representative for employer - even though I was advised that the third application was being made by a new service representative. Here is page 1 of the notice.

Thursday, April 21, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

Schedules were checked and a new hearing - the third one - was tentatively scheduled for October 5, 2010 at 10am. I so advised the claimant.

Wednesday, April 20, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

This notice generated some confusion - why would the Appeal Board not send me a copy? Why was it not a notice of a application to reopen? A few calls to the ALJ office revealed that the employer had changed service representatives and now the new service representative was making a third application to reopen.

Tuesday, April 19, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

Then in the beginning of August 2010, the claimant advised me that the DOL sent out a notice regarding the Employer's objection to benefits and a copy was forwarded to me by the claimant.

Monday, April 18, 2011

Sunday, April 17, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

After the decision, the wait began. For some reason, although I was listed as attorney for the claimant, the decision was not mailed to me so I asked the claimant to send me a copy. The claimant was still entitled to benefits but no one knew what the employer's next step would be.

Saturday, April 16, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

Friday, April 15, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

Thursday, April 14, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

Before I post the rest of the decision, note the following:

1. Although redacted from the March 20, 2011 post of the first default decision dated February 4, 2010, here I kept the name of the service representative for the employer - it is the same service representative for the first defaulted hearing of February 4, 2010.

2. At the bottom of the first page, the "Issues" that were to be presented at the July 19, 2010 hearing was the employer's application to reopen the default of February 4, 2010.

3. The bottom of the notice states in bold "EMPLOYER SECOND DEFAULT - EMPLOYER'S CASE". This advises everyone that the employer is the party who was requesting the hearing and that this is the second time the employer has made the claimant attend a hearing but did not show up.

Wednesday, April 13, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

A decision and notice of decision was mailed and dated July 19, 2010. Here is page 1 of the July 19, 2010 decision.

Tuesday, April 12, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

At this point, the Claimant's anxiety understandably continued. When the ALJ announced that there was a default, the ALJ did state to both myself and the Claimant that the Employer could and/or may apply to reopen again. Again, the applicable regulation is:

"Section 461.8 Reopening.

On application duly made, an administrative law judge may reopen a case where a decision was rendered upon or following the default of a party affected thereby or following the withdrawal of a request for hearing by a party. Such application shall be made to the chief administrative law judge or a senior administrative law judge who thereupon shall designate an administrative law judge to act upon the application. If such party shows good cause for his default or for his withdrawal of his request for a hearing, he shall be entitled to a hearing on the merits."

"Section 461.8 Reopening.

On application duly made, an administrative law judge may reopen a case where a decision was rendered upon or following the default of a party affected thereby or following the withdrawal of a request for hearing by a party. Such application shall be made to the chief administrative law judge or a senior administrative law judge who thereupon shall designate an administrative law judge to act upon the application. If such party shows good cause for his default or for his withdrawal of his request for a hearing, he shall be entitled to a hearing on the merits."

Monday, April 11, 2011

UNEMPLOYMENT INSURANCE - HEARINGS AND APPEALS - REOPENING DEFAULT - CASE NO. 4

Back to Case No. 4 and as a recap:

1. The Claimant was terminated.

2. The Claimant applied for UI benefits.

3. The Employer objected.

4. The DOL investigated.

5. The DOL determined that the Claimant was entitled to benefits.

6. The Employer filed a Request For Hearing.

7. The Employer defaulted at the hearing.

8. The ALJ upheld the determination of the DOL.

9. The Employer filed (it's first of many) application to reopen.

10. The Claimant contacted me for representation.

11. I requested the ALJ to transfer the case to the Garden City office.

12. The ALJ sent a notice of hearing for July 19, 2010.

Then, I reviewed the file, I had the Claimant furnish me with all the information I needed to present the Claimant's case, I researched the law and on July 19, 2010, the Claimant and I appeared - but the Employer defaulted. This is now Default Number 2: although this was my first hearing with the Claimant, this was the second time the Claimant appeared at a hearing and the second time the Employer defaulted.

1. The Claimant was terminated.

2. The Claimant applied for UI benefits.

3. The Employer objected.

4. The DOL investigated.

5. The DOL determined that the Claimant was entitled to benefits.

6. The Employer filed a Request For Hearing.

7. The Employer defaulted at the hearing.

8. The ALJ upheld the determination of the DOL.

9. The Employer filed (it's first of many) application to reopen.

10. The Claimant contacted me for representation.

11. I requested the ALJ to transfer the case to the Garden City office.

12. The ALJ sent a notice of hearing for July 19, 2010.

Then, I reviewed the file, I had the Claimant furnish me with all the information I needed to present the Claimant's case, I researched the law and on July 19, 2010, the Claimant and I appeared - but the Employer defaulted. This is now Default Number 2: although this was my first hearing with the Claimant, this was the second time the Claimant appeared at a hearing and the second time the Employer defaulted.

Sunday, April 10, 2011

NYS EDUCATION LAW - CHILD DOES NOT LIVE IN SCHOOL DISTRICT

As a final note, here is another recent decision from the Department of Education which will illustrate the issues regarding a change in residence. In summary, this is the issue facing parents in foreclosure and/or divorce. With respect to foreclosure:

1. If the school discovers that there has been a change of residence, the school has the option of excluding the child from the school. If it exercises that option, it also has the option to:

A. Permit the continued education of the child provided that the parents pay future tuition and reimburse for past tuition (which varies from district to district and can be high).

B. Exclude the child and start a court action for full reimbursement.

With respect to divorce, additional questions arise. The school of course has the same options as in foreclosure and can seek reimbursement (the liability again belonging to both parents) as set forth above. But what if the parents have consented to a parenting plan in which the child spends an equal amount of time at both residences? This must be addressed by attorneys for the spouses in the situation where such a parenting plan is adopted and the child is not attending a private education institution. And if the child is attending a public school and there is a change in residence but not a change in schools, the issue of a possible claim for reimbursement must be addressed in resolving the financial aspects of a divorce.

And what is interesting to note that in the following case, the issue was raised by an "anonymous report". This should alert parents that the "anonymous report" can be from a neighbor, an angry spouse, the school checking foreclosure notices, etc.

"Appeals of C.R., on behalf of her children B.R., M.R, B.R. and P.R., from action of the Board of Education of the Clarkstown Central School District regarding residency.

Decision No. 15,642

(August 20, 2007)

Feerick Lynch MacCartney, PLLC, attorneys for petitioner, Mary E. Marzolla, Esq., of counsel

Lexow, Berbit & Associates, P.C., attorneys for respondent, Susan Mills Richmond, Esq., of counsel

MILLS, Commissioner.--In two separate appeals, petitioner challenges the determination of the Board of Education of the Clarkstown Central School District (“respondent”) that her children are not district residents entitled to attend its schools tuition-free. Because the appeals present similar issues of fact and law, they are consolidated for decision. The appeals must be dismissed.

Petitioner is the mother of two sets of twins. During the 2006-2007 school year, twins B.R. and M.R. attended first grade, and twins B.R. and P.R. attended fourth grade in respondent’s district.

From 1997 until 1999, petitioner and the children’s father lived at Tennyson Drive, Nanuet, within respondent’s district. The residence at Tennyson Drive was owned by petitioner’s sister and is divided into two apartments.

In 1999, petitioner and the children’s father married and purchased a home at Green Bower Lane in New City, outside respondent’s district. Petitioner claims the family lived at the Green Bower Lane residence until petitioner and her husband separated “informally” in 2001.

After the separation, petitioner claims that she and the four children moved back to Tennyson Drive to live with her sister and mother in the home’s 774 sq. ft. lower-level apartment. Petitioner claims that her husband continues to reside alone at the Green Bower Lane residence, that the children regularly visit him there and that these visits include dinners and sleepovers.

On February 13, 2007, respondent received an anonymous report that petitioner resided outside its district. Based on this information, respondent hired an investigator to conduct surveillance on both the Tennyson Drive and Green Bower Lane residences.

On February 27, 2007, the investigator observed petitioner and two of the children arrive at the Tennyson Drive residence at approximately 6:54 a.m. The children exited the house and boarded respondent’s school bus at approximately 8:13 a.m. At approximately 3:05 p.m., the two children boarded respondent’s school bus and arrived at the Tennyson Drive residence at 3:30 p.m. At 3:39 p.m., petitioner and all four children exited the Tennyson Drive residence and drove to the Green Bower Lane residence.

On March 1, 2007, the investigator observed petitioner’s car at the Green Bower Lane residence at approximately 5:35 a.m. At approximately 6:09 a.m., petitioner and two of the children left the Green Bower Lane residence and drove to Tennyson Drive. The children exited the Tennyson Drive residence and boarded respondent’s school bus at 8:10 a.m.

On March 13, 2007, at approximately 6:44 a.m., the investigator observed petitioner, her husband, and all four children leave the Green Bower Lane residence in petitioner’s car.

By letter dated March 21, 2007, respondent’s supervisor of student support and community services (“supervisor”) notified petitioner that the district had obtained information indicating that petitioner was not a district resident. The letter stated that if petitioner failed to produce evidence of residency by March 30, 2007, all four children would be excluded from respondent’s schools after that date.

By letter dated April 10, 2007, petitioner produced copies of several documents to support her claim of residency, including her driver’s license, electric and gas bills for Tennyson Drive from 2002 through 2007, her automobile insurance identification card for a policy issued March 30, 2007, and her automobile registration, which was dated April 5, 2007. Petitioner also submitted a deed dated April 2, 2007 in which her sister transferred one-half of the Tennyson Drive property to petitioner.

In addition, petitioner produced notarized documents from her sister and mother stating that petitioner and the children live with them at Tennyson Drive. Petitioner also submitted several letters to support her residency claim, including one from a neighbor at Tennyson Drive and another from a woman who administered a speech language evaluation to one of the children at the Tennyson Drive residence in 2003.

By letter dated April 17, 2007, respondent’s director of business services (“director”) affirmed the determination that petitioner was not a district resident and stated that the children would be excluded from respondent’s schools after April 25, 2007. This appeal ensued. Petitioner’s request for interim relief was granted on April 26, 2007.

On May 15, 2007, petitioner served respondent with a second appeal in this matter (“second appeal”). The second appeal presents similar issues of fact and law and includes additional information in support of petitioner’s residency claim, including affidavits from her husband, sister and mother, and receipts for painting and the installation of new windows at the Tennyson Drive residence.

Petitioner claims, inter alia, that she is a district resident and that her children are entitled to attend respondent’s schools tuition-free. Petitioner also seeks an award of costs and attorney fees.

Respondent claims that petitioner resides outside its district and seeks tuition reimbursement in the amount of $87,099.11. Respondent also urges that petitioner’s second appeal not be considered on the grounds that it is an improper attempt to introduce evidence intended to buttress the claims asserted by petitioner in her original appeal.

Education Law §3202(1) provides, in pertinent part:

A person over five and under twenty-one years of age who has not received a high school diploma is entitled to attend the public schools maintained in the district in which such person resides without the payment of tuition.

The purpose of this statute is to limit the obligation of school districts to provide tuition-free education to students whose parents or legal guardians reside within the district (Appeal of Cross, 44 Ed Dept Rep 58, Decision No. 15,098; Appeal of G.P., 44 id. 52, Decision No. 15,096; Appeal of Chorro, 44 id. 50, Decision No. 15,095). “Residence” for purposes of Education Law §3202 is established by one’s physical presence as an inhabitant within the district and intent to reside in the district (Longwood Cent. School Dist. v. Springs Union Free School Dist., 1 NY3d 385; Appeal of Sigsby, 44 Ed Dept Rep 97, Decision No. 15,109; Appeal of W.D. and P.Z-D., 44 id. 77, Decision No. 15,104). A child's residence is presumed to be that of his or her parents or legal guardians (Catlin v. Sobol, 155 AD2d 24, revd on other grounds, 77 NY2d 552 (1991); Appeal of Innocent, 44 Ed Dept Rep 81, Decision No. 15,105).

A residency determination will not be set aside unless it is arbitrary and capricious (Appeals of St. Villien, 44 Ed Dept Rep 69, Decision No. 15,101; Appeal of I. B., 44 id. 44, Decision No. 15,093; Appeal of Hauk, 44 id. 36, Decision No. 15,090). In an appeal to the Commissioner, the petitioner has the burden of demonstrating a clear legal right to the relief requested and the burden of establishing the facts upon which petitioner seeks relief (8 NYCRR §275.10; Appeals of St. Villien, 44 Ed Dept Rep 69, Decision No. 15,101).

Petitioner claims that after she and her husband entered into an “informal and amicable” separation, she and the children moved back to her sister’s Tennyson Drive residence. To support her claim, petitioner submits several documents that list Tennyson Drive as her address. However, several of these documents originated after respondent’s residency investigation began. For example, the insurance and registration on petitioner’s car are dated March 30 and April 5, 2007, respectively. In addition, the deed from petitioner’s sister transferring a one-half interest in the Tennyson Drive property to petitioner is dated April 2, 2007.

In the second appeal, petitioner includes affidavits from her husband, sister, and mother -– each supporting the claims made in petitioner’s original appeal. Petitioner also includes receipts dated July 24, 2006 and January 19, 2007 indicating that she paid for improvements made to the Tennyson Drive residence.

While petitioner’s documentation indicates that she uses Tennyson Drive as her mailing address and may have paid some utility and repair bills for that residence, they are not dispositive of petitioner’s residency, particularly in light of the district’s investigation. Respondent also submitted evidence that petitioner and her husband remain co-owners of the Green Bower Lane residence, for which petitioner claims a STAR exemption.

Further, in response to the second appeal, respondent submitted an affidavit from its investigator stating that he interviewed a neighbor of the Tennyson Drive address. The neighbor stated that, “on a daily basis,” petitioner brings the children to the Tennyson Drive residence, where they board respondent’s school bus in the morning; that the children ride the bus to Tennyson Drive in the afternoon; and that petitioner and the children “would leave in the early evening and return the next day.”

Respondent also submitted affidavits from three of the children’s teachers stating that they have each had difficulty reaching petitioner at the Tennyson Drive address. One teacher stated, “Every time I called the in-district house, [petitioner] was never home. The grandmother stated that [petitioner] would get back to me ... [N]either child was able to learn nor repeat back his/her address or phone number.”

Based on the record before me, I find that petitioner has failed to establish that her children are district residents entitled to attend respondent’s schools tuition-free. Accordingly, respondent’s determination is neither arbitrary nor capricious and will not be set aside.

Although the petitions must be dismissed on the record before me, I note that petitioner has the right to reapply to the district for admission on her children’s behalf if circumstances have changed.

With respect to petitioner’s request for costs and attorney fees, the Commissioner has no authority to award monetary damages, costs or reimbursements in an appeal pursuant to Education Law §310 (Appeal of T.R. and M.D., 43 Ed Dept Rep 411, Decision No. 15,036; Appeal of L.D. and M.D., 43 id. 144, Decision No. 14,947; Appeal of Moore, 41 id. 436, Decision No. 14,738).

With respect to respondent’s claim for tuition reimbursement from petitioner in the amount of $87,099.11, I note that the Commissioner has historically declined to award tuition in residency appeals (Appeal of Crowley, 43 Ed Dept Rep 383, Decision No. 15,025; Appeal of Baronti, 42 id. 140, Decision No. 14,802; Appeal of a Student with a Disability, 41 id. 52, Decision No. 14,613). Such relief should be sought in a court of competent jurisdiction (Appeal of Crowley, 43 Ed Dept Rep 383, Decision No. 15,025).

THE APPEALS ARE DISMISSED."

1. If the school discovers that there has been a change of residence, the school has the option of excluding the child from the school. If it exercises that option, it also has the option to:

A. Permit the continued education of the child provided that the parents pay future tuition and reimburse for past tuition (which varies from district to district and can be high).

B. Exclude the child and start a court action for full reimbursement.

With respect to divorce, additional questions arise. The school of course has the same options as in foreclosure and can seek reimbursement (the liability again belonging to both parents) as set forth above. But what if the parents have consented to a parenting plan in which the child spends an equal amount of time at both residences? This must be addressed by attorneys for the spouses in the situation where such a parenting plan is adopted and the child is not attending a private education institution. And if the child is attending a public school and there is a change in residence but not a change in schools, the issue of a possible claim for reimbursement must be addressed in resolving the financial aspects of a divorce.

And what is interesting to note that in the following case, the issue was raised by an "anonymous report". This should alert parents that the "anonymous report" can be from a neighbor, an angry spouse, the school checking foreclosure notices, etc.

"Appeals of C.R., on behalf of her children B.R., M.R, B.R. and P.R., from action of the Board of Education of the Clarkstown Central School District regarding residency.

Decision No. 15,642

(August 20, 2007)

Feerick Lynch MacCartney, PLLC, attorneys for petitioner, Mary E. Marzolla, Esq., of counsel

Lexow, Berbit & Associates, P.C., attorneys for respondent, Susan Mills Richmond, Esq., of counsel

MILLS, Commissioner.--In two separate appeals, petitioner challenges the determination of the Board of Education of the Clarkstown Central School District (“respondent”) that her children are not district residents entitled to attend its schools tuition-free. Because the appeals present similar issues of fact and law, they are consolidated for decision. The appeals must be dismissed.

Petitioner is the mother of two sets of twins. During the 2006-2007 school year, twins B.R. and M.R. attended first grade, and twins B.R. and P.R. attended fourth grade in respondent’s district.

From 1997 until 1999, petitioner and the children’s father lived at Tennyson Drive, Nanuet, within respondent’s district. The residence at Tennyson Drive was owned by petitioner’s sister and is divided into two apartments.

In 1999, petitioner and the children’s father married and purchased a home at Green Bower Lane in New City, outside respondent’s district. Petitioner claims the family lived at the Green Bower Lane residence until petitioner and her husband separated “informally” in 2001.

After the separation, petitioner claims that she and the four children moved back to Tennyson Drive to live with her sister and mother in the home’s 774 sq. ft. lower-level apartment. Petitioner claims that her husband continues to reside alone at the Green Bower Lane residence, that the children regularly visit him there and that these visits include dinners and sleepovers.

On February 13, 2007, respondent received an anonymous report that petitioner resided outside its district. Based on this information, respondent hired an investigator to conduct surveillance on both the Tennyson Drive and Green Bower Lane residences.

On February 27, 2007, the investigator observed petitioner and two of the children arrive at the Tennyson Drive residence at approximately 6:54 a.m. The children exited the house and boarded respondent’s school bus at approximately 8:13 a.m. At approximately 3:05 p.m., the two children boarded respondent’s school bus and arrived at the Tennyson Drive residence at 3:30 p.m. At 3:39 p.m., petitioner and all four children exited the Tennyson Drive residence and drove to the Green Bower Lane residence.

On March 1, 2007, the investigator observed petitioner’s car at the Green Bower Lane residence at approximately 5:35 a.m. At approximately 6:09 a.m., petitioner and two of the children left the Green Bower Lane residence and drove to Tennyson Drive. The children exited the Tennyson Drive residence and boarded respondent’s school bus at 8:10 a.m.

On March 13, 2007, at approximately 6:44 a.m., the investigator observed petitioner, her husband, and all four children leave the Green Bower Lane residence in petitioner’s car.

By letter dated March 21, 2007, respondent’s supervisor of student support and community services (“supervisor”) notified petitioner that the district had obtained information indicating that petitioner was not a district resident. The letter stated that if petitioner failed to produce evidence of residency by March 30, 2007, all four children would be excluded from respondent’s schools after that date.

By letter dated April 10, 2007, petitioner produced copies of several documents to support her claim of residency, including her driver’s license, electric and gas bills for Tennyson Drive from 2002 through 2007, her automobile insurance identification card for a policy issued March 30, 2007, and her automobile registration, which was dated April 5, 2007. Petitioner also submitted a deed dated April 2, 2007 in which her sister transferred one-half of the Tennyson Drive property to petitioner.

In addition, petitioner produced notarized documents from her sister and mother stating that petitioner and the children live with them at Tennyson Drive. Petitioner also submitted several letters to support her residency claim, including one from a neighbor at Tennyson Drive and another from a woman who administered a speech language evaluation to one of the children at the Tennyson Drive residence in 2003.

By letter dated April 17, 2007, respondent’s director of business services (“director”) affirmed the determination that petitioner was not a district resident and stated that the children would be excluded from respondent’s schools after April 25, 2007. This appeal ensued. Petitioner’s request for interim relief was granted on April 26, 2007.

On May 15, 2007, petitioner served respondent with a second appeal in this matter (“second appeal”). The second appeal presents similar issues of fact and law and includes additional information in support of petitioner’s residency claim, including affidavits from her husband, sister and mother, and receipts for painting and the installation of new windows at the Tennyson Drive residence.

Petitioner claims, inter alia, that she is a district resident and that her children are entitled to attend respondent’s schools tuition-free. Petitioner also seeks an award of costs and attorney fees.

Respondent claims that petitioner resides outside its district and seeks tuition reimbursement in the amount of $87,099.11. Respondent also urges that petitioner’s second appeal not be considered on the grounds that it is an improper attempt to introduce evidence intended to buttress the claims asserted by petitioner in her original appeal.

Education Law §3202(1) provides, in pertinent part:

A person over five and under twenty-one years of age who has not received a high school diploma is entitled to attend the public schools maintained in the district in which such person resides without the payment of tuition.

The purpose of this statute is to limit the obligation of school districts to provide tuition-free education to students whose parents or legal guardians reside within the district (Appeal of Cross, 44 Ed Dept Rep 58, Decision No. 15,098; Appeal of G.P., 44 id. 52, Decision No. 15,096; Appeal of Chorro, 44 id. 50, Decision No. 15,095). “Residence” for purposes of Education Law §3202 is established by one’s physical presence as an inhabitant within the district and intent to reside in the district (Longwood Cent. School Dist. v. Springs Union Free School Dist., 1 NY3d 385; Appeal of Sigsby, 44 Ed Dept Rep 97, Decision No. 15,109; Appeal of W.D. and P.Z-D., 44 id. 77, Decision No. 15,104). A child's residence is presumed to be that of his or her parents or legal guardians (Catlin v. Sobol, 155 AD2d 24, revd on other grounds, 77 NY2d 552 (1991); Appeal of Innocent, 44 Ed Dept Rep 81, Decision No. 15,105).

A residency determination will not be set aside unless it is arbitrary and capricious (Appeals of St. Villien, 44 Ed Dept Rep 69, Decision No. 15,101; Appeal of I. B., 44 id. 44, Decision No. 15,093; Appeal of Hauk, 44 id. 36, Decision No. 15,090). In an appeal to the Commissioner, the petitioner has the burden of demonstrating a clear legal right to the relief requested and the burden of establishing the facts upon which petitioner seeks relief (8 NYCRR §275.10; Appeals of St. Villien, 44 Ed Dept Rep 69, Decision No. 15,101).

Petitioner claims that after she and her husband entered into an “informal and amicable” separation, she and the children moved back to her sister’s Tennyson Drive residence. To support her claim, petitioner submits several documents that list Tennyson Drive as her address. However, several of these documents originated after respondent’s residency investigation began. For example, the insurance and registration on petitioner’s car are dated March 30 and April 5, 2007, respectively. In addition, the deed from petitioner’s sister transferring a one-half interest in the Tennyson Drive property to petitioner is dated April 2, 2007.

In the second appeal, petitioner includes affidavits from her husband, sister, and mother -– each supporting the claims made in petitioner’s original appeal. Petitioner also includes receipts dated July 24, 2006 and January 19, 2007 indicating that she paid for improvements made to the Tennyson Drive residence.

While petitioner’s documentation indicates that she uses Tennyson Drive as her mailing address and may have paid some utility and repair bills for that residence, they are not dispositive of petitioner’s residency, particularly in light of the district’s investigation. Respondent also submitted evidence that petitioner and her husband remain co-owners of the Green Bower Lane residence, for which petitioner claims a STAR exemption.

Further, in response to the second appeal, respondent submitted an affidavit from its investigator stating that he interviewed a neighbor of the Tennyson Drive address. The neighbor stated that, “on a daily basis,” petitioner brings the children to the Tennyson Drive residence, where they board respondent’s school bus in the morning; that the children ride the bus to Tennyson Drive in the afternoon; and that petitioner and the children “would leave in the early evening and return the next day.”

Respondent also submitted affidavits from three of the children’s teachers stating that they have each had difficulty reaching petitioner at the Tennyson Drive address. One teacher stated, “Every time I called the in-district house, [petitioner] was never home. The grandmother stated that [petitioner] would get back to me ... [N]either child was able to learn nor repeat back his/her address or phone number.”

Based on the record before me, I find that petitioner has failed to establish that her children are district residents entitled to attend respondent’s schools tuition-free. Accordingly, respondent’s determination is neither arbitrary nor capricious and will not be set aside.

Although the petitions must be dismissed on the record before me, I note that petitioner has the right to reapply to the district for admission on her children’s behalf if circumstances have changed.

With respect to petitioner’s request for costs and attorney fees, the Commissioner has no authority to award monetary damages, costs or reimbursements in an appeal pursuant to Education Law §310 (Appeal of T.R. and M.D., 43 Ed Dept Rep 411, Decision No. 15,036; Appeal of L.D. and M.D., 43 id. 144, Decision No. 14,947; Appeal of Moore, 41 id. 436, Decision No. 14,738).

With respect to respondent’s claim for tuition reimbursement from petitioner in the amount of $87,099.11, I note that the Commissioner has historically declined to award tuition in residency appeals (Appeal of Crowley, 43 Ed Dept Rep 383, Decision No. 15,025; Appeal of Baronti, 42 id. 140, Decision No. 14,802; Appeal of a Student with a Disability, 41 id. 52, Decision No. 14,613). Such relief should be sought in a court of competent jurisdiction (Appeal of Crowley, 43 Ed Dept Rep 383, Decision No. 15,025).

THE APPEALS ARE DISMISSED."

Saturday, April 9, 2011

NYS EDUCATION LAW - CHILD DOES NOT LIVE IN SCHOOL DISTRICT

Here is another recent case. It illustrates the procedures involved. An investigation is done on residencey (here it was a temporary change). The school board sent a request for school tuition reimbursement and the issue of repayment must now be resolved in a regular court and not the DOE:

"Appeal of O.S. and D.S., on behalf of their children J.S. and K.S., from action of the Board of Education of the Herricks Union Free School District regarding residency.

Decision No. 16,201

(February 17, 2011)

Regina Brandow, P.C., attorneys for petitioner, Regina Brandow, Esq., of counsel

Jaspan Schlesinger LLP, attorneys for respondent, Lawrence J. Tenenbaum, Esq., of counsel

STEINER, Commissioner.--Petitioners appeal the determination of the Board of Education of the Herricks Union Free School District (“respondent”) that their children are not district residents. The appeal must be dismissed.

Petitioners have four children, two of whom, J.S. and K.S., are school age. On or about August 15, 2009, petitioners and their children moved into O.S.’s parents’ home on Bellwood Drive in New Hyde Park (“Bellwood address”), in respondent’s district. Thereafter, they registered J.S. and K.S. in the district’s schools. On or about September 15, 2009, O.S.’s father purchased a home on Hillside Boulevard in New Hyde Park (“Hillside address”), outside respondent’s district. Following an investigation, on or about December 9, 2009, the superintendent notified petitioners that J.S. and K.S. were not district residents and would be excluded from the district’s schools, effective December 18, 2009. O.S. and her mother met with the superintendent on December 16, 2009 and stated that petitioners still lived at the Bellwood address.

Additional surveillance was conducted and by letter dated March 9, 2010, the superintendent advised petitioners that their residency in the district was in question. After a residency meeting on March 22, 2010, the superintendent notified petitioners by letter dated March 23, 2010, that J.S. and K.S. were not district residents and would be excluded from attending district schools effective April 5, 2010. The district further claimed back tuition in the amount of $10,529.40 for each child for the period of September 1, 2009 through April 5, 2010. On April 13, 2010, petitioners appealed the superintendent’s decision to respondent. Respondent denied petitioners’ appeal and this appeal ensued.

Petitioners allege that they resided at the Bellwood address from September 2009 through April 5, 2010 while they were renovating the Hillside address. Petitioners request a determination that J.S. and K.S. were residents of the district, entitled to attend its schools without payment of tuition, from September 2009 through April 5, 2010.

Respondent maintains that it properly determined that petitioners’ children were not district residents and that the appeal is moot. Respondent also challenges the scope of petitioners’ reply.

The appeal must be dismissed as moot. The Commissioner will only decide matters in actual controversy and will not render a decision on a state of facts which no longer exist or which subsequent events have laid to rest (Appeal of a Student with a Disability, 48 Ed Dept Rep 532, Decision No. 15,940; Appeal of M.M., 48 id. 527, Decision No. 15,937; Appeal of Embro, 48 id. 204, Decision No. 15,836). Petitioners withdrew J.S. and K.S. from the district’s schools in April 2010. Accordingly, their residency is no longer at issue.

Petitioners argue that the appeal is not moot because respondent has sent them non-resident tuition bills for the period from September 2009 through April 5, 2010 when J.S. and K.S. attended school in the district. The Commissioner has historically declined to award tuition in residency appeals (Appeal of Clark, 48 Ed Dept Rep 337, Decision No. 15,876; Appeal of C.S., 47 id. 407, Decision No. 15,737). Such relief should be sought in a court of competent jurisdiction (Appeal of Clark, 48 Ed Dept Rep 337, Decision No. 15,876; Appeal of C.S., 47 id. 407, Decision No. 15,737). Therefore, any discussion of the merits of petitioners’ residency claim for the time period at issue would be advisory in nature. It is well established that the Commissioner does not issue advisory opinions or declaratory rulings in an appeal pursuant to Education Law §310 (Appeal of a Student with a Disability, 48 Ed Dept Rep 411, Decision No. 15,899; Appeal of Waechter, 48 id. 261, Decision No. 15,853). Accordingly, the appeal must be dismissed (see Appeal of Butler and Dunham, 50 Ed Dept Rep __, Decision No. 16,103; Appeal of Azatyan, 49 Ed Dept Rep 65, Decision No. 15,959).

THE APPEAL IS DISMISSED."

"Appeal of O.S. and D.S., on behalf of their children J.S. and K.S., from action of the Board of Education of the Herricks Union Free School District regarding residency.

Decision No. 16,201

(February 17, 2011)

Regina Brandow, P.C., attorneys for petitioner, Regina Brandow, Esq., of counsel

Jaspan Schlesinger LLP, attorneys for respondent, Lawrence J. Tenenbaum, Esq., of counsel

STEINER, Commissioner.--Petitioners appeal the determination of the Board of Education of the Herricks Union Free School District (“respondent”) that their children are not district residents. The appeal must be dismissed.

Petitioners have four children, two of whom, J.S. and K.S., are school age. On or about August 15, 2009, petitioners and their children moved into O.S.’s parents’ home on Bellwood Drive in New Hyde Park (“Bellwood address”), in respondent’s district. Thereafter, they registered J.S. and K.S. in the district’s schools. On or about September 15, 2009, O.S.’s father purchased a home on Hillside Boulevard in New Hyde Park (“Hillside address”), outside respondent’s district. Following an investigation, on or about December 9, 2009, the superintendent notified petitioners that J.S. and K.S. were not district residents and would be excluded from the district’s schools, effective December 18, 2009. O.S. and her mother met with the superintendent on December 16, 2009 and stated that petitioners still lived at the Bellwood address.

Additional surveillance was conducted and by letter dated March 9, 2010, the superintendent advised petitioners that their residency in the district was in question. After a residency meeting on March 22, 2010, the superintendent notified petitioners by letter dated March 23, 2010, that J.S. and K.S. were not district residents and would be excluded from attending district schools effective April 5, 2010. The district further claimed back tuition in the amount of $10,529.40 for each child for the period of September 1, 2009 through April 5, 2010. On April 13, 2010, petitioners appealed the superintendent’s decision to respondent. Respondent denied petitioners’ appeal and this appeal ensued.

Petitioners allege that they resided at the Bellwood address from September 2009 through April 5, 2010 while they were renovating the Hillside address. Petitioners request a determination that J.S. and K.S. were residents of the district, entitled to attend its schools without payment of tuition, from September 2009 through April 5, 2010.

Respondent maintains that it properly determined that petitioners’ children were not district residents and that the appeal is moot. Respondent also challenges the scope of petitioners’ reply.

The appeal must be dismissed as moot. The Commissioner will only decide matters in actual controversy and will not render a decision on a state of facts which no longer exist or which subsequent events have laid to rest (Appeal of a Student with a Disability, 48 Ed Dept Rep 532, Decision No. 15,940; Appeal of M.M., 48 id. 527, Decision No. 15,937; Appeal of Embro, 48 id. 204, Decision No. 15,836). Petitioners withdrew J.S. and K.S. from the district’s schools in April 2010. Accordingly, their residency is no longer at issue.

Petitioners argue that the appeal is not moot because respondent has sent them non-resident tuition bills for the period from September 2009 through April 5, 2010 when J.S. and K.S. attended school in the district. The Commissioner has historically declined to award tuition in residency appeals (Appeal of Clark, 48 Ed Dept Rep 337, Decision No. 15,876; Appeal of C.S., 47 id. 407, Decision No. 15,737). Such relief should be sought in a court of competent jurisdiction (Appeal of Clark, 48 Ed Dept Rep 337, Decision No. 15,876; Appeal of C.S., 47 id. 407, Decision No. 15,737). Therefore, any discussion of the merits of petitioners’ residency claim for the time period at issue would be advisory in nature. It is well established that the Commissioner does not issue advisory opinions or declaratory rulings in an appeal pursuant to Education Law §310 (Appeal of a Student with a Disability, 48 Ed Dept Rep 411, Decision No. 15,899; Appeal of Waechter, 48 id. 261, Decision No. 15,853). Accordingly, the appeal must be dismissed (see Appeal of Butler and Dunham, 50 Ed Dept Rep __, Decision No. 16,103; Appeal of Azatyan, 49 Ed Dept Rep 65, Decision No. 15,959).

THE APPEAL IS DISMISSED."

Friday, April 8, 2011

NYS EDUCATION LAW - CHILD DOES NOT LIVE IN SCHOOL DISTRICT

Here is a typical fact pattern of what happens in a divorce situation with respect to the child continuing in a school district:

"Appeal of GARY HELMS, on behalf of his son, DAVID, from action of the Board of Education of the Deer Park Union Free School District regarding residency.

Decision No. 13,668

(August 28, 1996)

Arnold J. Hauptman, Esq., attorney for petitioner

Cooper, Sapir & Cohen, P.C., attorneys for respondent, Robert E. Sapir, Esq., of counsel

MILLS, Commissioner.--Petitioner appeals respondent's determination that his son, David, is not a resident of the Deer Park Union Free School District ("district") and is, therefore, not entitled to attend its schools tuition-free. The appeal must be dismissed.

At the beginning of the 1995-96 school year, David lived with his parents at 12 Hendel Circle, Deer Park, and attended the district's high school. In December 1995, petitioner became involved in a divorce action with David's mother. As a result of this dispute, on January 4, 1996, petitioner and his son moved to 19 Bagatelle Road, Dix Hills, an address located outside the district. David's mother continues to reside at 12 Hendel Circle, in the district.

In the context of the pending divorce action, both petitioner and David's mother have sought custody of David. However, there is no evidence that the court has issued a temporary or permanent order concerning custody.

By letter dated March 26, 1996, the district's attendance teacher notified petitioner that since he and David resided outside the district, David was no longer eligible to attend the district's schools. Petitioner's attorney appealed the decision to respondent. On April 2, 1996, respondent denied the appeal.

Petitioner commenced this appeal on April 4, 1996 and requested an interim order. On April 16, 1996, Acting Commissioner Sheldon issued an interim order directing respondent to admit David to the district's schools pending a determination on the merits.

Petitioner contends that his residence outside the district is temporary. Petitioner further contends that until the court determines custody, David's residence remains in the district. Respondent maintains that petitioner and his son reside at an address outside the district. Respondent further maintains that there is no evidence that David will ever return to reside in the district.

Education Law '3202(1) provides, in pertinent part:

A person over five and under twenty-one years of age who has not received a high school diploma is entitled to attend the public schools maintained in the district in which such person resides without the payment of tuition.

A child's residence is presumed to be that of his parents (Appeal of Juracka, 31 Ed Dept Rep 282; Appeal of Forde, 29 id. 359). Where a child's parents live apart, the child can have only one legal residence (People ex. rel. The Brooklyn Children's Aid Society v. Hendrickson, et al., 54 Misc 337, 104 NYS 122, aff'd. 196 NY 551; Appeal of Juracka, supra; Matter of Manning, 24 Ed Dept Rep 33). Where a child's time is divided between two households, the determination of the child's residence rests ultimately with the family (Appeal of Juracka, supra; Appeal of Forde, supra).

In this case, it is undisputed that David lives with petitioner outside the district. Further, there is no evidence that David spends any time at his mother's residence in the district.

There is insufficient evidence in the record to support petitioner's assertion that his residence outside the district is temporary. The record indicates that petitioner and his son moved to an apartment outside the district. Although petitioner contends that he will seek possession of the marital residence if the court awards him custody, it is not known when and if he will in fact return to the marital residence. Further, there is no evidence that petitioner intends to make arrangements to establish another residence in respondent's district if he cannot return to the marital residence. In addition, the record is devoid of any evidence that petitioner continues to maintain significant community ties within the district other than his son's continued attendance in the district's schools. Therefore, I am unable to conclude on the record before me that petitioner is in fact temporarily housed outside the district and is actively taking steps to return there (Appeal of Kenneth R., 30 Ed Dept Rep 297).

It appears from the record that it is petitioner's intention to gain permanent custody of David and to have him continue to reside with him. Since residence is based upon an individual's physical presence within the district and intention to remain (Appeal of Kind, 32 Ed Dept Rep 584; Appeal of Bonfante-Ceruti, 31 id. 38), I find that respondent correctly concluded that David does not reside within the district.

Education Law '3202(2) authorizes a school district to condition a nonresident's enrollment in its schools upon the payment of tuition. Since David is not a resident of respondent's district, respondent has the authority to require petitioner to pay tuition as a condition of David's continued enrollment. To the extent petitioner pays school taxes on his property in respondent's district, he is entitled to a deduction from the established tuition in the amount of such tax, as provided in Education Law '3202(3).

Finally, I note that David's residency status may change in the event David's mother is awarded custody or if petitioner moves back into respondent's district. In either event, the child's status should be re-evaluated by respondent.

THE APPEAL IS DISMISSED."

"Appeal of GARY HELMS, on behalf of his son, DAVID, from action of the Board of Education of the Deer Park Union Free School District regarding residency.

Decision No. 13,668

(August 28, 1996)

Arnold J. Hauptman, Esq., attorney for petitioner

Cooper, Sapir & Cohen, P.C., attorneys for respondent, Robert E. Sapir, Esq., of counsel

MILLS, Commissioner.--Petitioner appeals respondent's determination that his son, David, is not a resident of the Deer Park Union Free School District ("district") and is, therefore, not entitled to attend its schools tuition-free. The appeal must be dismissed.

At the beginning of the 1995-96 school year, David lived with his parents at 12 Hendel Circle, Deer Park, and attended the district's high school. In December 1995, petitioner became involved in a divorce action with David's mother. As a result of this dispute, on January 4, 1996, petitioner and his son moved to 19 Bagatelle Road, Dix Hills, an address located outside the district. David's mother continues to reside at 12 Hendel Circle, in the district.

In the context of the pending divorce action, both petitioner and David's mother have sought custody of David. However, there is no evidence that the court has issued a temporary or permanent order concerning custody.

By letter dated March 26, 1996, the district's attendance teacher notified petitioner that since he and David resided outside the district, David was no longer eligible to attend the district's schools. Petitioner's attorney appealed the decision to respondent. On April 2, 1996, respondent denied the appeal.

Petitioner commenced this appeal on April 4, 1996 and requested an interim order. On April 16, 1996, Acting Commissioner Sheldon issued an interim order directing respondent to admit David to the district's schools pending a determination on the merits.

Petitioner contends that his residence outside the district is temporary. Petitioner further contends that until the court determines custody, David's residence remains in the district. Respondent maintains that petitioner and his son reside at an address outside the district. Respondent further maintains that there is no evidence that David will ever return to reside in the district.

Education Law '3202(1) provides, in pertinent part:

A person over five and under twenty-one years of age who has not received a high school diploma is entitled to attend the public schools maintained in the district in which such person resides without the payment of tuition.

A child's residence is presumed to be that of his parents (Appeal of Juracka, 31 Ed Dept Rep 282; Appeal of Forde, 29 id. 359). Where a child's parents live apart, the child can have only one legal residence (People ex. rel. The Brooklyn Children's Aid Society v. Hendrickson, et al., 54 Misc 337, 104 NYS 122, aff'd. 196 NY 551; Appeal of Juracka, supra; Matter of Manning, 24 Ed Dept Rep 33). Where a child's time is divided between two households, the determination of the child's residence rests ultimately with the family (Appeal of Juracka, supra; Appeal of Forde, supra).

In this case, it is undisputed that David lives with petitioner outside the district. Further, there is no evidence that David spends any time at his mother's residence in the district.

There is insufficient evidence in the record to support petitioner's assertion that his residence outside the district is temporary. The record indicates that petitioner and his son moved to an apartment outside the district. Although petitioner contends that he will seek possession of the marital residence if the court awards him custody, it is not known when and if he will in fact return to the marital residence. Further, there is no evidence that petitioner intends to make arrangements to establish another residence in respondent's district if he cannot return to the marital residence. In addition, the record is devoid of any evidence that petitioner continues to maintain significant community ties within the district other than his son's continued attendance in the district's schools. Therefore, I am unable to conclude on the record before me that petitioner is in fact temporarily housed outside the district and is actively taking steps to return there (Appeal of Kenneth R., 30 Ed Dept Rep 297).

It appears from the record that it is petitioner's intention to gain permanent custody of David and to have him continue to reside with him. Since residence is based upon an individual's physical presence within the district and intention to remain (Appeal of Kind, 32 Ed Dept Rep 584; Appeal of Bonfante-Ceruti, 31 id. 38), I find that respondent correctly concluded that David does not reside within the district.

Education Law '3202(2) authorizes a school district to condition a nonresident's enrollment in its schools upon the payment of tuition. Since David is not a resident of respondent's district, respondent has the authority to require petitioner to pay tuition as a condition of David's continued enrollment. To the extent petitioner pays school taxes on his property in respondent's district, he is entitled to a deduction from the established tuition in the amount of such tax, as provided in Education Law '3202(3).

Finally, I note that David's residency status may change in the event David's mother is awarded custody or if petitioner moves back into respondent's district. In either event, the child's status should be re-evaluated by respondent.

THE APPEAL IS DISMISSED."

Thursday, April 7, 2011

NYS EDUCATION LAW - CHILD DOES NOT LIVE IN SCHOOL DISTRICT

Here is the statute from the NYS Education Law:

"§ 3202. Public schools free to resident pupils; tuition from

nonresident pupils. 1. A person over five and under twenty-one years of

age who has not received a high school diploma is entitled to attend the

public schools maintained in the district in which such person resides

without the payment of tuition. Provided further that such person may

continue to attend the public school in such district in the same

manner, if temporarily residing outside the boundaries of the district

when relocation to such temporary residence is a consequence of such

person's parent or person in parental relationship being called to

active military duty, other than training. Notwithstanding any other

provision of law to the contrary, the school district shall not be

required to provide transportation between a temporary residence located

outside of the school district and the school the child attends. A

veteran of any age who shall have served as a member of the armed forces

of the United States and who shall have been discharged therefrom under

conditions other than dishonorable, may attend any of the public schools

of the state upon conditions prescribed by the board of education, and

such veterans shall be included in the pupil count for state aid

purposes. A nonveteran under twenty-one years of age who has received a

high school diploma shall be permitted to attend classes in the schools

of the district in which such person resides or in a school of a board

of cooperative educational services upon payment of tuition under such

terms and conditions as shall be established in regulations promulgated

by the commissioner; provided, however, that a school district may waive

the payment of tuition for such nonveteran, but in any case such a

nonveteran who has received a high school diploma shall not be counted

for any state aid purposes. Nothing herein contained shall, however,

require a board of education to admit a child who becomes five years of

age after the school year has commenced unless his birthday occurs on or

before the first of December.

1-a. No pupil over the compulsory attendance age in his or her school

district shall be dropped from enrollment unless he or she has been

absent twenty consecutive school days and the following procedure is

complied with: The principal or superintendent shall schedule and

notify, in writing and at the last known address, both the student and

the person in parental relation to the student of an informal

conference. At the conference the principal or superintendent shall

determine both the reasons for the pupil's absence and whether

reasonable changes in the pupil's educational program would encourage

and facilitate his or her re-entry or continuance of study. The pupil

and the person in parental relation shall be informed orally and in

writing of the pupil's right to re-enroll at any time in the public

school maintained in the district where he or she resides, if otherwise

qualified under this section. If the pupil and the person in parental

relationship fail, after reasonable notice, to attend the informal

conference, the pupil may be dropped from enrollment provided that he or

she and the person in parental relation are notified in writing of the

right to re-enter at any time, if otherwise qualified under this

section.

2. Nonresidents of a district, if otherwise competent, may be admitted

into the school or schools of a district or city, upon the consent of

the trustees or the board of education, upon terms prescribed by such

trustees or board.

3. The school authorities of a district or city must deduct from the

tuition of a nonresident pupil, whose parent or guardian owns property

in such district or city and pays a tax thereon for the support of the

schools maintained in such district or city, the amount of such tax.

4. a. Except as provided in subdivision five of this section, the cost

of instruction of pupils placed in family homes at board by a social

services district or a state department or agency shall be borne by the

school district in which each such pupil resided at the time the social

services district or state department or agency assumed responsibility

for the placement, support and maintenance of such pupil; provided,

however, that such cost of instruction shall continue to be borne, while

such pupil remains under the age of twenty-one years, by any social

services district or state department or agency which assumed

responsibility for tuition costs for any such pupil prior to January

one, nineteen hundred seventy-four. Where a pupil is placed pursuant to

this subdivision outside the pupil's school district of residence at the

time of such placement, the cost of instruction shall be borne by the

district of residence and the tuition paid to the school district

furnishing instruction shall be computed as provided in paragraph d of

this subdivision, except that, where the family home at board receives

program support from a child care institution affiliated with a special

act school district as defined in subdivision eight of section four

thousand one of this chapter, and the board of education of such

district furnishing instruction, upon the recommendation of its

committee on special education, contracts for such pupil's education

pursuant to paragraph c, d, e, or f of subdivision two of section

forty-four hundred one of this chapter or for a nonresidential placement

pursuant to paragraph l of such subdivision, costs incurred shall be

reimbursed in accordance with paragraph e of this subdivision.

Notwithstanding any inconsistent provision of law, where the permanent

residence of a pupil is outside of the state, the school district in

which the pupil was located at the time the public agency placed such

pupil shall be deemed the district of residence of such pupil for

purposes of this subdivision and shall be responsible for the cost of

instruction of such pupil.

b. Children cared for in free family homes and children cared for in

family homes at board, when such family homes shall be the actual and

only residence of such children and when such children are not supported

and maintained at the expense of a social services district or of a

state department or agency, shall be deemed residents of the school

district in which such family home is located.

c. Children cared for in free family homes and children cared for in

family homes at board, when such family homes are not the actual and

only residences of such children and when such children are not

supported and maintained at the expense of a social services district or

of a state department or agency, and who apply for the first time for

admittance to the schools of the district in which such family home is

located during the school year 1973--1974 shall be admitted upon terms

and conditions including the payment of tuition, established by the

board of education of such school district, unless such board of

education shall establish to the satisfaction of the commissioner that

there are valid and sufficient reasons for refusal to receive such

children.

d. For the purposes of this subdivision, tuition shall be fixed in an

amount which represents the additional operating cost to the school

district resulting from the attendance of a child for whom tuition is

required, computed in accordance with a formula established by the

commissioner of education.

e. Where the board of education of a school district furnishing

instruction for a pupil placed pursuant to this subdivision in a family

home at board that receives program support from a child care

institution affiliated with a special act school district, other than

the board of the pupil's school district of residence as defined in

paragraph a of this subdivision, upon the recommendation of its

committee on special education, contracts for the instruction of such

pupil pursuant to paragraph c, d, e, or f of subdivision two of section

forty-four hundred one of this chapter or for a nonresidential placement

pursuant to paragraph l of such subdivision, such board shall submit a

claim to the commissioner for current year reimbursement of costs

incurred for such pupil. The commissioner shall pay such claim in

accordance with the applicable provisions of section thirty-six hundred

nine-b of this chapter and shall be reimbursed by the school district

identified as the pupil's school district of residence as defined in

paragraph a of this subdivision. The commissioner shall deduct the

amount of such claim from moneys otherwise due the school district of

residence.

f. The identity of the school district of residence at the time the

public agency placed the pupil pursuant to paragraph a or paragraph e of

this subdivision shall be established in accordance with the following

procedure:

(i) Within ten days of the placement of such pupil, the public agency

or its designee shall give written notice of such placement to the board

of education of the school district believed to be the school district

of residence. Such notification shall include the name of the pupil and

any particulars about the pupil that pertain to the identification of

the school district as the school district of residence as defined in

paragraph a of this subdivision.

(ii) A board of education of a school district which receives

notification pursuant to subparagraph (i) of this paragraph may submit

to the public agency, within ten days of its receipt of such notice,

additional evidence to establish that it is not the pupil's district of

residence as defined in paragraph a of this subdivision. Any evidence so

submitted shall be considered by the agency prior to making its final

determination, which shall be made no later than five days after the

agency's receipt of such additional evidence. In the event such school

district fails to submit additional evidence within such ten day period,

the determination of the public agency shall be final and the

notification provided pursuant to subparagraph (i) of this paragraph

shall be deemed final notification of such determination.

(iii) If, upon its review, the public agency determines that the

school district notified pursuant to subparagraph (i) of this paragraph

was not the pupil's district of residence, the public agency shall send

notification to the correct school district, in the form prescribed by

subparagraph (i) of this paragraph. Alternatively, if, upon its review,

the public agency determines that the school district originally

designated pursuant to subparagraph (i) of this paragraph is the pupil's

district of residence the public agency shall notify such district in

writing of its final determination.

(iv) The board of education of the school district finally determined

by the public agency to be the pupil's school district of residence may

appeal such determination to the commissioner within thirty days of its

receipt of final notification pursuant to this paragraph. Such an appeal

shall be conducted in the same manner as an appeal from the actions of

local school officials pursuant to section three hundred ten of this

chapter, except that the factual allegations of the petitioner shall not

be deemed true in the event the public agency elects not to appear in

the appeal. The petitioner shall join as a party to the appeal any other

school district suspected to be the pupil's actual school district of

residence.

(v) If the commissioner finds that the school district notified

pursuant to subparagraph (i) or (iii) of this paragraph was not the

pupil's school district of residence as defined in paragraph a of this

subdivision and that the correct school district was not joined as a

party to the appeal, the commissioner shall direct the public agency to

notify the correct school district pursuant to subparagraph (i) of this

paragraph.

(vi) Notwithstanding any inconsistent provisions of law, during the

pendency of all proceedings to review a denial of financial

responsibility, the commissioner shall issue an interim order assigning

such financial responsibility to the school district or, alternatively,

upon a determination that the public agency failed to make reasonable

efforts to identify the residence of such child, to the public agency.

In the event the public agency fails to provide timely notice pursuant

to subparagraph (i) of this paragraph, or fails to render its final

determination in a timely manner, the public agency responsible for such

pupil's residential placement shall reimburse the commissioner for the

payments made to the district furnishing instruction pursuant to this

paragraph during the pendency of all proceedings or for the duration of

the current school year, whichever is longer, and the state comptroller

shall withhold such amount from any moneys due the county or the city of

New York, on vouchers certified or approved by the commissioner, in the

manner prescribed by law or shall transfer such amount from the account

of such state department or agency upon certification of the

commissioner, and such funds shall be credited to the general support

for public schools local assistance account of the department.

(vii) Any final determination or order of the commissioner concerning

the school district of residence of any pupil under this section may

only be reviewed in a proceeding brought in the supreme court pursuant

to article seventy-eight of the civil practice law and rules. In any

such proceeding under such article seventy-eight, the court may grant

any relief authorized by the provisions of section seventy-eight hundred