Tuesday, December 31, 2019

Monday, December 30, 2019

ON FORMING A CHAMBER OF COMMERCE IN NEW YORK

Recently, it had been a struggle for myself and one of the corporate service to create a chamber of commerce pursuant to Section 1410 of the Not-for-Profit Corporation Law.

"Chamber of Commerce" is a prohibited term when used to create in the name of a Business Corporation (“BC”), Limited Liability Company (“LLC”) and/or Limited Partnership (“LP”). See https://www.dos.ny.gov/corps/restricted_words.html But it is not prohibited or otherwise restricted in the name of a corporation created as a Not-for Profit Corporation (“N-PC”), . Some corporate services as well as staff at the Department of State, Division of Corporations are not aware of this due, in part, to a quick reading of the above link of restricted terms. Below is the email that confirmed this:

"-----Original Message-----

From: dos.sm.Corp.InetCorp

Sent: Friday, December 27, 2019 9:59 AM

To: jmp@jmpattorney.com

Subject: RE: NFP Name Prohibition

A chamber of commerce may be formed pursuant to Section 1410 of the Not-for-Profit Corporation Law. "Chamber of Commerce" is not prohibited or otherwise restricted in the name of the corporation.

-----Original Message-----

From: Jon Probstein <jmp@jmpattorney.com>

Sent: Monday, December 16, 2019 2:35 PM

To: dos.dl.InetCorporations <dos.dl.InetCorporations@dos.ny.gov>

Subject: NFP Name Prohibition

Hello:

I am attempting to form a NFP Corp using the phrase "Chamber of Commerce". According to the divisions website, chamber of commerce is not prohibited for N-PC (see https://www.dos.ny.gov/corps/restricted_words.html). Please confirm this because my XXXX service will not file unless I have a statement from your office that this is not prohibited for a NFP."

Friday, December 27, 2019

CONSUMER VICTORY OVER FALSE ADVERTISING

"Bait and Switch" is a deceptive business act and practice.

Castillo v. 189 Sunrise Hwy Auto LLC, NYLJ December 26, 2019, Date filed: 2019-12-13, Court: Appellate Term, Second Department, 2nd, 11th & 13th Judicial Districts, Judge: Per Curiam, Case Number: 2018-328KC:

Plaintiff

commenced this action to recover the principal sum of $25,000 as a

result of defendant’s allegedly deceptive acts and practices (General

Business Law §349), based on false advertising, failing to refund

overpaid funds and forcing miscellaneous fees on customers (first cause

of action), and false advertising (General Business Law §350) (second

cause of action). The false advertising claims were based on defendant’s

refusal to sell plaintiff a used 2015 Nissan Sentra for$9,985, the

price that defendant had posted in two online advertisements.

Plaintiff’s third and fourth causes of action also alleged violations of

General Business Law §3501 because, after having purchased

the vehicle at a higher price than advertised, plaintiff was caused to

overpay for registration and other miscellaneous fees, which amounts

have not been refunded. In its answer, defendant admitted to having

placed advertisements for a 2015 Nissan Sentra for $9,985.

When plaintiff failed to respond to its discovery demands, defendant moved to preclude plaintiff from offering any evidence at trial. Plaintiff cross-moved for summary judgment. In support of his cross motion, plaintiff stated that he had gone to defendant’s showroom to purchase a used 2015 Nissan Sentra for the $9,985 price listed in defendant’s advertisements but defendant had refused to sell it for that price. Plaintiff subsequently purchased the vehicle in question from defendant for the price of $12,500. Plaintiff sought, as damages, among other things, the difference between what the car had been advertised for and the price he had ultimately paid for the car. In an affidavit in opposition to plaintiff’s cross motion, defendant’s salesman averred that plaintiff had been told that the purchase price was $12,980 and that, after a $2,995 deposit, there would be a balance due of $9,985. The salesman further stated that after plaintiff had been told that the price of the car was $12,980, plaintiff left the showroom, shopped at other dealers and then returned to defendant, informing the salesman that defendant’s price of $12,980 was the lowest around. Defendant subsequently lowered the price to $12,500, and plaintiff purchased the car. In his reply, plaintiff denied that he had shopped around before he had purchased the vehicle. By order dated October 30, 2017, the Civil Court denied both defendant’s motion to preclude and plaintiff’s cross motion for summary judgment. Plaintiff appeals from so much of the order as denied his cross motion.

In 1980, New York amended its consumer protection act, General Business Law article 22-A, §349 et seq., to provide a private right of action for injuries caused by deceptive acts and practices(General Business Law §349 [h]), and false advertising (General Business Law §350-e [3]).

General Business Law §350 prohibits false advertising, which means advertising which is “misleading in a material respect” (General Business Law §350-a). “To successfully assert a claim under General Business Law §349 (h) or §350, a plaintiff must allege that a defendant has engaged in (1) consumer-oriented conduct that is (2) materially misleading and that (3) plaintiff suffered injury as a result of the allegedly deceptive act or practice” (Koch v. Acker, Merrall & Condit Co.,18 NY3d 940, 941 [2012] [internal quotation marks omitted]).2 A plaintiff need not prove intent to deceive to establish false advertising (see Geismar v. Abraham & Strauss, 109 Misc 2d 495 [Suffolk Dist Ct 1981]).

Upon the record before us, we find that plaintiff established that he was deceived by the two online advertisements to the extent that he was led to believe that he would be able to purchase the used 2015 Nissan Sentra in question from defendant for the price of $9,985. Inasmuch as plaintiff traveled from Brooklyn to defendant’s showroom in Amityville on the basis of the advertisements, and defendant refused to sell the car for the advertised price, plaintiff was misled and suffered injury(see Beslity v. Manhattan Honda, 120 Misc 2d 848, 854 [App Term, 1st Dept 1983]). Defendant provided no explanation for the variance in price. Thus, pursuant to General Business Law §350-e(3), plaintiff is entitled to recover, on his second cause of action, his actual damages, here, the difference between the advertised price and the price plaintiff paid (but see Beslity v. Manhattan Honda, 120 Misc 2d 848). As we find, under the circumstances presented, that plaintiff’s cause of action for false advertising based on General Business Law §350 (second cause of action) overlaps so much of his General Business Law §349 cause of action (first cause of action) as involved his false advertisement claim (see Koch v. Acker, Merrall & Condit Co., 18 NY3d at 941), he cannot recover on his first cause of action under General Business Law §349 to the extent that the first cause of action is based on false advertising.

Plaintiff also sought summary judgment with respect to the remainder of his first cause of action and his third and fourth causes of action involving miscellaneous fees and overpayments. However, he failed to establish his entitlement to judgment as a matter of law with respect to those fees and overpayments.

Accordingly, the order, insofar as appealed from, is modified by providing that the branch of plaintiff’s cross motion seeking summary judgment on his second cause of action pursuant to section 350 of the General Business Law for falsely advertising the purchase price of a vehicle is granted and plaintiff is awarded the principal sum of $2,515 on that cause of action.

ELLIOT, J.P., PESCE and SIEGAL, JJ., concur.

2. "The standard for recovery under General Business Law §350, while specific to false advertising, is otherwise identical to §349" (Goshen v. Mutual Life Ins. Co., 98 NY2d 314, 324 n 1 [2002]). While §349 (h) provides for the recovery by a private individual of his actual damages or $50, whichever is greater, §350-e initially provided the same but was amended in 2007 to provide for the recovery of one's actual damages or $500, whichever is greater.

When plaintiff failed to respond to its discovery demands, defendant moved to preclude plaintiff from offering any evidence at trial. Plaintiff cross-moved for summary judgment. In support of his cross motion, plaintiff stated that he had gone to defendant’s showroom to purchase a used 2015 Nissan Sentra for the $9,985 price listed in defendant’s advertisements but defendant had refused to sell it for that price. Plaintiff subsequently purchased the vehicle in question from defendant for the price of $12,500. Plaintiff sought, as damages, among other things, the difference between what the car had been advertised for and the price he had ultimately paid for the car. In an affidavit in opposition to plaintiff’s cross motion, defendant’s salesman averred that plaintiff had been told that the purchase price was $12,980 and that, after a $2,995 deposit, there would be a balance due of $9,985. The salesman further stated that after plaintiff had been told that the price of the car was $12,980, plaintiff left the showroom, shopped at other dealers and then returned to defendant, informing the salesman that defendant’s price of $12,980 was the lowest around. Defendant subsequently lowered the price to $12,500, and plaintiff purchased the car. In his reply, plaintiff denied that he had shopped around before he had purchased the vehicle. By order dated October 30, 2017, the Civil Court denied both defendant’s motion to preclude and plaintiff’s cross motion for summary judgment. Plaintiff appeals from so much of the order as denied his cross motion.

In 1980, New York amended its consumer protection act, General Business Law article 22-A, §349 et seq., to provide a private right of action for injuries caused by deceptive acts and practices(General Business Law §349 [h]), and false advertising (General Business Law §350-e [3]).

General Business Law §350 prohibits false advertising, which means advertising which is “misleading in a material respect” (General Business Law §350-a). “To successfully assert a claim under General Business Law §349 (h) or §350, a plaintiff must allege that a defendant has engaged in (1) consumer-oriented conduct that is (2) materially misleading and that (3) plaintiff suffered injury as a result of the allegedly deceptive act or practice” (Koch v. Acker, Merrall & Condit Co.,18 NY3d 940, 941 [2012] [internal quotation marks omitted]).2 A plaintiff need not prove intent to deceive to establish false advertising (see Geismar v. Abraham & Strauss, 109 Misc 2d 495 [Suffolk Dist Ct 1981]).

Upon the record before us, we find that plaintiff established that he was deceived by the two online advertisements to the extent that he was led to believe that he would be able to purchase the used 2015 Nissan Sentra in question from defendant for the price of $9,985. Inasmuch as plaintiff traveled from Brooklyn to defendant’s showroom in Amityville on the basis of the advertisements, and defendant refused to sell the car for the advertised price, plaintiff was misled and suffered injury(see Beslity v. Manhattan Honda, 120 Misc 2d 848, 854 [App Term, 1st Dept 1983]). Defendant provided no explanation for the variance in price. Thus, pursuant to General Business Law §350-e(3), plaintiff is entitled to recover, on his second cause of action, his actual damages, here, the difference between the advertised price and the price plaintiff paid (but see Beslity v. Manhattan Honda, 120 Misc 2d 848). As we find, under the circumstances presented, that plaintiff’s cause of action for false advertising based on General Business Law §350 (second cause of action) overlaps so much of his General Business Law §349 cause of action (first cause of action) as involved his false advertisement claim (see Koch v. Acker, Merrall & Condit Co., 18 NY3d at 941), he cannot recover on his first cause of action under General Business Law §349 to the extent that the first cause of action is based on false advertising.

Plaintiff also sought summary judgment with respect to the remainder of his first cause of action and his third and fourth causes of action involving miscellaneous fees and overpayments. However, he failed to establish his entitlement to judgment as a matter of law with respect to those fees and overpayments.

Accordingly, the order, insofar as appealed from, is modified by providing that the branch of plaintiff’s cross motion seeking summary judgment on his second cause of action pursuant to section 350 of the General Business Law for falsely advertising the purchase price of a vehicle is granted and plaintiff is awarded the principal sum of $2,515 on that cause of action.

ELLIOT, J.P., PESCE and SIEGAL, JJ., concur.

Footnotes

1. The third cause of action was subtitled breach of contract and the fourth cause of action was subtitled unjust enrichment.2. "The standard for recovery under General Business Law §350, while specific to false advertising, is otherwise identical to §349" (Goshen v. Mutual Life Ins. Co., 98 NY2d 314, 324 n 1 [2002]). While §349 (h) provides for the recovery by a private individual of his actual damages or $50, whichever is greater, §350-e initially provided the same but was amended in 2007 to provide for the recovery of one's actual damages or $500, whichever is greater.

Thursday, December 26, 2019

Tuesday, December 24, 2019

Monday, December 23, 2019

Friday, December 20, 2019

ADDRESSING ZOMBIE HOMES

Effective as of December 18, a new section 1392 of the real property actions and proceedings law has been enacted which authorizes local governments to commence judicial proceedings in courts of competent jurisdiction to compel mortgagees to either complete mortgage foreclosure actions or to issue certificates of discharge for the mortgage for properties that have been certified as abandoned pursuant to real property actions and proceedings law section 1971.

This legislation is designed to financially benefit municipalities in allowing them to reclaim and redevelop "zombie properties"in order to return them to the property tax rolls.

Labels:

zombie homes

Thursday, December 19, 2019

GUARDIANS DO NOT HAVE AUTHORITY TO START A DIVORCE PROCEEDING

This is the law as it continues today.

DE v. PA, 2016 NY Slip Op 51230 - NY: Supreme Court 2016:

"However, defendant also contends that Ms. K. cannot maintain this divorce action for plaintiff, as the guardian of the person and property of an incompetent person cannot maintain an action of absolute divorce against the incompetent person's spouse. In re Wechsler, 3AD3d 424 (1st Dept. 2004); Mohrmann v. Kob, 291 NY 181 (1943).

In Mohrmann, 291 NY 181, the Court of Appeals determined that then present Civil Practice Act Section 1147 prohibited the committee of the property of an incompetent person to prosecute an action for divorce on behalf of the incompetent person, as that section limits the right to maintain an action to procure a judgment of divorce to a husband or wife.[2] The Mohrmann Court wrote

[i]t has been suggested that the authority granted to the committee of the property of an incompetent person by section 1377 of the Civil Practice Act is broad enough in scope to include an action for divorce on behalf of the incompetent. We think that when the Legislature by section 1147 of the Civil Practice Act limited to a husband or a wife' the right to maintain an action against the other party to the marriage to procure a judgment divorcing the parties and dissolving the marriage by reason of the defendant's adultery', the statutory restriction thus placed upon the right to bring such an action was not relaxed by the provisions of section 1377. The committee of the property of an incompetent has the duty of protecting the property of his ward and for that purpose has been given by section 1377 a general power to maintain in his own name any action which the person with respect to whom he is appointed might have maintained if the appointment had not been made.' A statute conferring upon the committee of the property of an incompetent a general power should not be construed to include the right to choose for the incompetent whether or not to ask the courts to dissolve the marriage tie in order to free the incompetent from its incidental obligations. It is our view that when the Legislature by section 1377 authorized the committee of the property of an incompetent person to bring any action or special proceeding' in behalf of the incompetent, the use of the word any' did not include an action for divorce which the Legislature has always treated separately and completely.Mohrmann, 291 NY at 188-189.

Many years later in In re Wechsler, 3 AD3d 424 (1st Dept. 2004), the First Department, citing to Mohrmann as being dispositive on the issue, held that the guardian of the incompetent husband could not institute a no-fault divorce proceeding in Pennsylvania against the wife, despite the grant of authority to the guardian to "maintain any civil judicial proceeding." The Wechsler Court wrote that in Mohrmann the Court of Appeals "noted that whether to pursue divorce proceedings is a personal decision in which the element of volition is implicit." In re Wechsler, 3 AD3d 424. The Court further opined that "absent statutory authority permitting a guardian to commence a divorce on behalf of a ward, the courts may not assume to grant such power (citations omitted). Id. at 425."

Labels:

divorce,

Guardianships,

mental capacity

Wednesday, December 18, 2019

GUN SAFETY IN NEW YORK - ARTICLE 63-A OF CPLR

Effective August 24, 2019, Article 63-A of the CPLR was enacted giving certain individuals and institutions the right to seek an "Extreme risk protection order", defined as a court-issued order of protection prohibiting a person from purchasing, possessing or attempting to purchase or possess a firearm, rifle or shotgun.

Forms and instructions are available on the New York Courts website at:

https://ww2.nycourts.gov/erpo

Labels:

Extreme Risk Protection Order,

guns

Tuesday, December 17, 2019

E FILING ELIMINATES EXCUSE FOR DEAFULT

E Filing is convenient but it also negates a lack of notice.

U.S. Bank, N.A. v Essaghof, 2019 NY Slip Op 08888, Decided on December 11, 2019, Appellate Division, Second Department:

"We agree with the Supreme Court's determination to deny the defendants' motion pursuant to CPLR 5015(a)(1). "A party seeking to vacate an order entered upon his or her failure to oppose a motion is required to demonstrate, through the submission of supporting facts in evidentiary form, both a reasonable excuse for the default and the existence of a potentially meritorious opposition to the motion" (Bhuiyan v New York City Health & Hosps. Corp., 120 AD3d 1284, 1284; see CPLR 5015[a][1]; Kondrotas-Williams v Westbridge Enters., Inc., 170 AD3d 983, 985; Soto v Chelsea W26, LLC, 166 AD3d 1048, 1049). "The determination of what constitutes a reasonable excuse lies within the sound discretion of the Supreme Court" (Nationstar Mtge., LLC v Ramnarine, 172 AD3d 886, 886; see Hudson City Sav. Bank v Bomba, 149 AD3d 704, 705; New Century Mtge. Corp. v Chimmiri, 146 AD3d 893, 894). "The court has discretion to accept law office failure as a reasonable excuse (see CPLR 2005) where the claim is supported by a detailed and credible explanation of the default" (Option One Mtge. Corp. v Rose, 164 AD3d 1251, 1252; see Torres v Rely On Us, Inc., 165 AD3d 731, 733; GMAC Mtge., LLC v Guccione, 127 AD3d 1136, 1138). "Conclusory and unsubstantiated allegations of law office failure are not sufficient" (Torres v Rely On Us, Inc., 165 AD3d at 733 [internal quotation marks omitted]; see LaSalle Bank, N.A. v LoRusso, 155 AD3d 706, 707; U.S. Bank N.A. v Barr, 139 AD3d 937, 937-938). "[M]ere neglect [*2]is not a reasonable excuse" (Torres v Rely On Us, Inc., 165 AD3d at 733 [internal quotation marks omitted]; see OneWest Bank, FSB v Singer, 153 AD3d 714, 716; JP Morgan Chase Bank, N.A. v Russo, 121 AD3d 1048, 1049).

In support of their motion, the defendants submitted an affirmation from their attorney, who explained that he had left for Florida on a two-week vacation for his wedding and honeymoon a day before the plaintiff served and filed its motion. Counsel asserted that, when he returned and checked his unread emails, the email to which the plaintiff's motion papers were annexed was not among his unread emails, and therefore he was "unaware that Plaintiff had filed [its] motion."

In opposition to the defendants' motion, the plaintiff submitted copies of numerous New York State Courts Electronic Filing (hereinafter NYSCEF) email notifications and alerts from the Supreme Court, Suffolk County, sent prior to the return date of the plaintiff's motion, demonstrating that at least five separate automated court notices concerning the plaintiff's motion filing had been emailed to the defendants' attorney prior to the return date of the plaintiff's motion, including one that was emailed more than two weeks after the defendants' attorney left for his two-week vacation. Absent any explanation that would take into account the email notification that arrived after he had returned to the office, and his failure to provide the exact details concerning when he became aware of the default and precisely what he did upon learning of the order granting the plaintiff's unopposed motion (cf. Diamond v Leone, 173 AD3d 686, 687-688), the defendants' claim of law office failure was insufficient to demonstrate a reasonable excuse for their default (see Option One Mtge. Corp. v Rose, 164 AD3d at 1252)."

Labels:

CPLR 5015,

E filing,

Motion To Vacate,

reasonable excuse

Monday, December 16, 2019

UNEMPLOYMENT INSURANCE - DOCUMENTING THE NEED FOR ACCOMODATION

Matter of Pham (Sperber, Denenberg & Kahan, PC-Commissioner of Labor), State of New York Supreme Court, Appellate Division Third Judicial Department, Decided and Entered: December 12, 2019, Index 529274:

"Claimant worked as an associate attorney for the employer, a law firm in New York City. In January 2018, she had hip replacement surgery and was granted a medical leave of absence. Prior to the surgery, her legal duties consisted primarily of transactional work, such as real estate closings, that she performed in the employer's office. During the time that claimant was out on medical leave, the employer found it necessary to hire another attorney to handle the transactional work. When claimant returned to work in early May 2018, her legal duties had changed and, during her first week back, she spent most of her time appearing in court at various locations throughout the city. In addition, she scheduled her physical therapy appointments at times during the work day that were not satisfactory to the employer. One week after claimant returned to work, she resigned from her position.

Claimant applied for unemployment insurance benefits and an initial determination was rendered finding her eligible to receive them. The employer objected and, following a hearing, an Administrative Law Judge overruled the initial determination and found that claimant was disqualified from receiving benefits because she voluntarily left her employment without good cause. The Unemployment Insurance Appeal Board upheld this decision and denied claimant's subsequent application for reopening and/or reconsideration. Claimant appeals from the Board's decision disqualifying her from receiving benefits.

Claimant argues, among things, that the Board erred in overruling the initial determination finding her eligible to receive benefits. Initially, "[w]hether a claimant has good cause to leave his or her employment so as to qualify for unemployment insurance benefits is a factual determination to be made by the Board, and its decision will not be disturbed when supported by substantial evidence" (Matter of Roberson [Commissioner of Labor], 142 AD3d 1259, 1260 [2016] [internal quotation marks and citations omitted]; see Matter of Torres [Commissioner of Labor], 111 AD3d 1215, 1215 [2013]). Notably, general dissatisfaction with one's job or work environment does not constitute good cause for leaving one's employment (see Matter of Tsirakis [Commissioner of Labor], 122 AD3d 994, 995 [2014]; Matter of Bielak [Commissioner of Labor], 105 AD3d 1226, 1226 [2013]).

Claimant testified that she returned to work with a cane and had difficulty traveling to court appearances carrying files and using public transportation. She also stated that the employer took issue with her scheduling of physical therapy appointments during the work day and reprimanded her for going to such an appointment on one occasion after she finished a court appearance. According to claimant, she resigned from her position because she was no longer doing the transactional work, which was less physically taxing given her mobility problems, and she perceived the work environment to be hostile considering the employer's attitude toward her physical therapy appointments. Claimant, however, conceded that she never told the employer that she had a medical condition making it hard for her to go to court, and her physician did not indicate that she had any specific medical restrictions. Likewise, representatives for the employer stated that claimant never disclosed that she had any medical restrictions despite their requests for such information. Given the absence of documentation substantiating claimant's medical restrictions (see Matter of Skura [Commissioner of Labor], 116 AD3d 1330, 1331 [2014]) or any indication that the employer had notice of such restrictions and was provided an opportunity to accommodate them (see Matter of Roberson [Commissioner of Labor], 142 AD3d at 1261), substantial evidence supports the Board's finding that claimant left her job for personal and noncompelling reasons. We have considered claimant's remaining contentions and find them to be unpersuasive."

Friday, December 13, 2019

AMENDMENT TO LIMITED LIABILITY LAW

Effective within 60 days, subdivision (c) of section 609 of the Limited Liability Company Law shall be amended. According to the Senate bill "Limited Liability Company Law § 609 imposes liability for unpaid wages on the members with the 10 largest ownership interests after a judgment against the corporation has been returned unsatisfied. This bill ensures that all foreign Limited Liability Companies employing workers in New York State are treated the same in the eyes of the law as domestic LLCs. In 2015, legislation was enacted which ended the distinction under which foreign corporations had been exempted by court decision from this rule. Likewise, the law should be clear that foreign LLCs should abide by the same rule as domestic LLCs, thereby eliminating any incentive for an LLC doing business in New York State to form under the laws of a foreign state."

Labels:

foreign LLC,

LLC,

Wages

Thursday, December 12, 2019

AWARDING ATTORNEY FEES IN A MATRIMONIAL

Litigation can be costly in a divorce when the income/asset spouse unnecessarily and aggressively prolongs the litigation.

Klein v Klein, 2019 NY Slip Op 08836, Decided on December 11, 2019, Appellate Division, Second Department:

"The decision to award an attorney's fee in a matrimonial action lies, in the first instance, in the discretion of the trial court and then in the Appellate Division whose discretionary authority is as broad as that of the trial court" (Black v Black, 140 AD3d 816, 816 [internal quotation marks omitted]; see Culen v Culen, 157 AD3d 930, 932). "In exercising that discretion, the court must consider the financial circumstances of the parties and the circumstances of the case as a whole, including the relative merits of the parties' positions" (Mueller v Mueller, 113 AD3d 660, 661; see Margolis v Cohen, 153 AD3d 1390; Matter of Weiss v Rosenthal, 135 AD3d 780, 781). Additionally, the court may also consider whether one party has engaged in conduct or taken positions resulting in a delay of the proceedings or engaged in unnecessary litigation (see Giallo-Uvino v Uvino, 165 AD3d 894, 897; Matter of Weiss v Rosenthal, 135 AD3d at 781; Prichep v Prichep, 52 AD3d 61, 64). Here, considering the disparity of income between the parties, the relative merits of the parties' positions, and the defendant's conduct that delayed the proceedings, the Supreme Court providently exercised its discretion in awarding the plaintiff attorney's fees in the sum of $40,000 and expert witness fees in the sum of $36,000, and in directing the defendant to pay $100,000 in attorney's fees directly to the plaintiff's attorney's law firm (see Romeo v Muenzler-Romeo, 169 AD3d 845, 846; Belilos v Rivera, 164 AD3d at 1415; Babinski v Babinski, 152 AD3d 477, 478; Chesner v Chesner, 95 AD3d 1252, 1253)."

Labels:

Attorneys Fees,

divorce

Wednesday, December 11, 2019

THE RETURN OF YELLOWSTONE

Awaiting signature by the Governor is S5614 which adds a new section 235-h to the real property law and prohibits commercial leases from including a waiver of the right to a declaratory judgment action and states that the inclusion of such a waiver in a commercial lease shall be null and void as against public policy. As the Senate stated:

"For the last 50 years, in cases where a landlord serves a commercial tenant with a notice to cure a defect, and seeks to terminate a lease if the defaults under the lease are not cured within a certain amount of time, the tenant has had the right to seek additional time to cure. The commercial tenant has been able to file for an injunction to toll the period of time allowed to cure the default, and to prevent the landlord from terminating the lease. This is known as a Yellowstone injunction, (see First Nail. Stores v. Yellowstone Shopping Ctr., 21 N.Y.2d 630 (1968). Until recently the question of whether a commercial tenant could waive its right to obtain a Yellowstone injunction had not been ruled upon by an appeals court until a recent ruling in the Second Department of the Appellate Division (159 MP Corp. v. Redbridge Bedford, 2018 N.Y. Slip. Op. 00537 (2d Dept, Jan.31, 2018) held the waiver language in the lease was enforceable and not against public policy. The court further found that the legislature "has not enacted any specific or blanket statutory provision prohibiting as void or unenforceable a tenant's waiver of declaratory judgment remedies." This legislation seeks to enact such a provision as a matter of public policy and restore the right of commercial tenants to cure under a declaratory judgment action as has been the practice since 1968. The ability to cure through this process protects commercial tenants from landlords seeking to remove tenants in the middle of a lease period without appropriate ability to cure or judicial review. To allow waiver clauses of the Yellowstone injunction will be disruptive of commerce, unfair to commercial tenants and allow landlords to use minor lease issues as a method to remove and replace tenants in the middle of lease terms. Commercial landlords would be able to prematurely terminate leas- es whenever they wanted to force a tenant out, whether the default was legitimate or not, and the tenant who agreed to a waiver would have no recourse."

Labels:

Commercial Lease,

Yellowstone Injunction

Monday, December 9, 2019

MY MOTHER - IN MEMORY OF

My mother Lila Probstein passed away at 94 so please excuse this form of notice as, between all the arrangements, I am unable to make the calls I would like to have made. We will be having a private grave site service today with just myself and my children, Michael and Megan. Shiva is at my house, 21 Turn Lane, Levittown, NY, this afternoon from 3-8 and a memorial dinner will be held later in the year. If there is any one who you know to pass this information on to, please do.

Friday, December 6, 2019

THE LONG ARM OF NEW YORK JURISDICTION

A New York bank account is transacting business.

Skutnik v Messina, 2019 NY Slip Op 08725, Decided on December 4, 2019, Appellate Division, Second Department:

"The plaintiff commenced this action to recover damages for breach of contract, alleging that the defendant failed to repay a loan made in 2002. The plaintiff allegedly funded the loan through multiple wire transfers into the defendant's bank account in New York. The defendant moved, in effect, pursuant to CPLR 3211(a)(8) to dismiss the complaint for lack of personal jurisdiction, contending that he had resided in Florida since 2001. The plaintiff cross-moved, inter alia, to direct the defendant to appear for a deposition for the purpose of determining the issue of whether there was personal jurisdiction over the defendant. The Supreme Court, among other things, granted the defendant's motion to dismiss the complaint and denied, as academic, that branch of the plaintiff's cross motion which was to direct the defendant to appear for a deposition. The plaintiff appeals.

"Although a plaintiff is not required to plead and prove personal jurisdiction in the complaint, where jurisdiction is contested, the ultimate burden of proof rests upon the plaintiff" (Hopstein v Cohen, 143 AD3d 859, 860 [internal quotation marks omitted]; see Pichardo v Zayas, 122 AD3d 699, 700; Mejia-Haffner v Killington, Ltd., 119 AD3d 912, 914). "In opposing a motion to dismiss the complaint pursuant to CPLR 3211(a)(8) on the ground of lack of jurisdiction, a plaintiff need only make a prima facie showing that such jurisdiction exists" (Hopstein v Cohen, 143 AD3d at 860 [internal quotation marks omitted]).

CPLR 302(a)(1) provides that "a court may exercise personal jurisdiction over any non-domiciliary . . . who in person or through an agent . . . transacts any business within the state." "The CPLR 302(a)(1) jurisdictional inquiry is twofold: under the first prong the defendant must have conducted sufficient activities to have transacted business in the state, and under the second prong, [*2]the claims must arise from the transactions" (Nick v Schneider, 150 AD3d 1250, 1251 [internal quotation marks omitted]; see Rushaid v Pictet & Cie, 28 NY3d 316, 323). The sufficient activities requirement is satisfied "so long as the defendant's activities here were purposeful" (Rushaid v Pictet & Cie, 28 NY3d at 323 [internal quotation marks omitted]; see Nick v Schneider, 150 AD3d at 1252). "Purposeful activities are those with which a defendant, through volitional acts, avails [himself or herself] of the privilege of conducting activities within the forum State, thus invoking the benefits and protections of its laws" (Fischbarg v Doucet, 9 NY3d 375, 380 [internal quotation marks omitted]; see Nick v Schneider, 150 AD3d at 1252).

"To satisfy the second prong of CPLR 302(a)(1) that the cause of action arise from the contacts with New York, there must be an articulable nexus . . . or substantial relationship . . . between the business transaction and the claim asserted" (Rushaid v Pictet & Cie, 28 NY3d at 329 [internal quotation marks omitted]; see Licci v Lebanese Can. Bank, SAL, 20 NY3d 327, 339; Nick v Schneider, 150 AD3d at 1252). "This inquiry is relatively permissive, and does not require causation, but merely a relatedness between the transaction and the legal claim such that the latter is not completely unmoored from the former, regardless of the ultimate merits of the claim" (Rushaid v Pictet & Cie, 28 NY3d at 329 [citations and internal quotation marks omitted]; see Nick v Schneider, 150 AD3d at 1252). "CPLR 302(a)(1) is a single act statute and proof of one transaction in New York is sufficient to invoke jurisdiction, even though the defendant never enters New York, so long as the defendant's activities here were purposeful and there is a substantial relationship between the transaction and the claim asserted" (Zottola v AGI Group, Inc., 63 AD3d 1052, 1054 [internal quotation marks omitted]; see Deutsche Bank Sec., Inc. v Montana Bd. of Invs., 7 NY3d 65, 71).

Here, in opposition to the defendant's motion, the plaintiff made a prima facie showing that the defendant transacted business in New York and that the plaintiff's claims arose from those transactions, so as to establish jurisdiction pursuant to CPLR 302(a)(1). The emails submitted by the plaintiff regarding the subject loan included an email from the defendant dated May 8, 2002, wherein the defendant requested that the plaintiff send him multiple loan disbursements by wire transfers into a bank account in Smithtown, New York, for which the defendant provided an account number and a routing number. The plaintiff's submissions demonstrated that the defendant maintained a bank account in New York for the purpose of availing himself of the privilege of conducting business activities in New York, and that he purposefully used that account to conduct the very transactions that are the subject of this action (see Licci v Lebanese Can. Bank, SAL, 20 NY3d 327).

Accordingly, the Supreme Court should have denied the defendant's motion, in effect, pursuant to CPLR 3211(a)(8) to dismiss the complaint for lack of personal jurisdiction."

Labels:

LITIGATION,

Personal Jurisdiction

Thursday, December 5, 2019

NEW RULES - LANDLORD HARASSMENT OF RENT REGULATED TENANTS HAVE CRIMINAL RAMIFICATIONS

The penal law has been amended to better protect tenants from the egregious misconduct of unscrupulous landlords by broadening the definition of the class E felony offense of Harassment of a Rent Regulated Tenant and by establishing a related class A misdemeanor offense in Article 241 of the Penal Law.

A full copy of the bill, signed into law on Tuesday, as the "Tenant Protection Act of 2019", can be found at https://www.nysenate.gov/legislation/bills/2019/s2605

Labels:

Harassment,

Landlord Tenant Law,

Penal Law

Wednesday, December 4, 2019

MORTGAGE FORECLOSURE - RPAPL 1304 ON APPEAL

Once again this homeowner defense prevails on appeal.

HSBC Bank USA, N.A. v Sawh, 2019 NY Slip Op 08556, Decided on November 27, 2019. Appellate Division, Second Department:

"On January 5, 2007, the defendant Vishnu Sawh (hereinafter the defendant) executed a note in the principal sum of $679,672. The note was secured by a mortgage on certain residential property located in South Ozone Park. The defendant allegedly defaulted by failing to make the monthly payment due on December 1, 2011, and all subsequent payments thereafter.

In 2013, the plaintiff commenced the instant foreclosure action against the defendant, among others. The defendant interposed an answer in which he alleged that the plaintiff failed to comply with RPAPL 1304. The plaintiff moved, inter alia, for summary judgment on the complaint insofar as asserted against the defendant, to strike his answer, and to appoint a referee to calculate amounts due.

In support of the motion, the plaintiff submitted, inter alia, the affidavit of Jerrell Menyweather, an assistant secretary employed by Nationstar Mortgage LLC, the plaintiff's loan servicer.

By order dated February 20, 2015, the Supreme Court granted the plaintiff's motion. Upon completion of the referee's report, the plaintiff moved to confirm the report and for a judgment of foreclosure and sale.

In an order dated October 25, 2016, the Supreme Court granted the plaintiff's motion. On February 2, 2017, the court entered a judgment of foreclosure and sale directing the sale of the subject property.

The defendant appeals.

RPAPL 1304(1) provides that, "at least ninety days before a lender, an assignee or a mortgage loan servicer commences legal action against the borrower . . . , including mortgage foreclosure, such lender, assignee or mortgage loan servicer shall give notice to the borrower." "The statute further provides the required content for the notice and provides that the notice must be sent by registered or certified mail and also by first-class mail to the last known address of the borrower" (Citibank, N.A. v Conti-Scheurer, 172 AD3d 17, 20; see RPAPL 1304[2]). "Strict compliance with RPAPL 1304 notice to the borrower or borrowers is a condition precedent to the commencement of a foreclosure action" (Citibank, N.A. v Conti-Scheurer, 172 AD3d at 20; see Citimortgage, Inc. v Banks, 155 AD3d 936, 936-937; HSBC Bank USA, N.A. v Ozcan, 154 AD3d 822, 825-826). "By requiring the lender or mortgage loan servicer to send the RPAPL 1304 notice by registered or certified mail and also by first-class mail, the Legislature implicitly provided the means for the plaintiff to demonstrate its compliance with the statute, i.e., by proof of the requisite mailing, which can be established with proof of the actual mailings, such as affidavits of mailing or domestic return receipts with attendant signatures, or proof of a standard office mailing procedure designed to ensure that items are properly addressed and mailed, sworn to by someone with personal knowledge of the procedure" (Citibank, N.A. v Conti-Scheurer, 172 AD3d at 20-21 [internal quotation marks omitted]; see Bank of Am., N.A. v Bittle, 168 AD3d 656, 658; Wells Fargo Bank, NA v Mandrin, 160 AD3d 1014, 1016).

Here, the plaintiff failed to establish, prima facie, that it complied with RPAPL 1304 (see Citibank, N.A. v Conti-Scheurer, 172 AD3d at 21; Wells Fargo Bank, N.A. v Trupia, 150 AD3d 1049, 1050-1051). Although Menyweather stated in his affidavit that the RPAPL 1304 notices were mailed by regular and certified mail, and attached copies of the notices, the plaintiff failed to attach, as exhibits to the motion, any documents establishing that the notices were actually mailed (see Citibank, N.A. v Conti-Scheurer, 172 AD3d at 21; U.S. Bank N.A. v Offley, 170 AD3d 1240, 1242; Wells Fargo Bank, N.A. v Taylor, 170 AD3d 921, 923; Bank of N.Y. Mellon v Zavolunov, 157 AD3d 754, 756). The plaintiff failed to submit a copy of any United States Post Office document indicating that the notice was sent by registered or certified mail as required by the statute (see Citibank, N.A. v Conti-Scheurer, 172 AD3d at 21). Further, although Menyweather attested that he had personal knowledge of the loan servicer's records, and that those records included the records of the prior servicer, Bank of America, Menyweather did not attest to knowledge of the mailing practices of Bank of America, the entity that allegedly sent the 90-day notices to the defendant (see id.; Wells Fargo Bank, N.A. v Moran, 168 AD3d 1128, 1128). Since the plaintiff failed to provide evidence of the actual mailing, or evidence of a standard office mailing procedure designed to ensure that the items were properly addressed and mailed, sworn to by someone with personal knowledge of the procedure, the plaintiff failed to establish its strict compliance with RPAPL 1304 (see Citibank, N.A. v Conti-Scheurer, 172 AD3d at 21).

Because the plaintiff failed to satisfy its prima facie burden with respect to RPAPL 1304, those branches of its motion which were for summary judgment on the complaint insofar as asserted against the defendant, to strike that defendant's answer, and for an order of reference should have been denied, regardless of the sufficiency of the defendant's opposition papers (see Winegrad v New York Univ. Med. Ctr., 64 NY2d 851, 853)."

Labels:

appeals,

Mortgage Foreclosure,

RPAPL 1304

Tuesday, December 3, 2019

PARTY FAILS TO COMPLY WITH DISCOVERY ORDERS

If the credibility of court orders and the integrity of our judicial system are to be maintained, a litigant cannot ignore court orders with impunity.

HSBC Bank USA, N.A. v Branker 2019 NY Slip Op 08555 Decided on November 27, 2019 Appellate Division, Second Department:

"In March 2013, the plaintiff commenced this action against, among others, the defendant Vista Holding, LLC (hereinafter the defendant). The defendant interposed an answer asserting various affirmative defenses. In January 2014, the plaintiff, moved, inter alia, for summary judgment on the complaint insofar as asserted against the defendant. In an order dated June 4, 2014, the Supreme Court summarily denied the plaintiff's motion. The plaintiff filed a notice of appeal from the June 4, 2014, order, but then failed to perfect the appeal, resulting in its dismissal. In October 2014, the plaintiff moved for leave to reargue its motion for summary judgment. In an order dated March 11, 2015, the court granted reargument and, upon reargument, adhered to its prior determination. The plaintiff filed a notice of appeal from the March 11, 2015, order, but then withdrew the appeal.

In a notice for discovery and inspection dated September 17, 2015, the defendant sought certain documents from the plaintiff. The plaintiff objected to the requests on the grounds, inter alia, that the documents sought were not relevant. In a compliance conference order dated November 4, 2015, the plaintiff was directed to fully respond to the defendant's September 17, 2015, discovery request. The order expressly found that the plaintiff's response had been inadequate and the plaintiff was required to produce the documents requested, and the order further warned that unjustified noncompliance with its terms may result in the imposition of sanctions.

The plaintiff moved by notice dated May 17, 2016, for leave to renew its prior motion for reargument of its motion for summary judgment. While that motion was pending, in a compliance conference order dated May 23, 2016, the plaintiff was directed to comply with the November 4, 2015, order and the defendant's September 17, 2015, discovery request within 45 days. [*2]The May 23, 2016, order warned that the unjustified failure to comply with its terms "will result in the striking of a pleading" (emphasis in original). Notwithstanding the plaintiff's prior objections to the requested discovery, the compliance conference order was entered on the parties' consent. The order reflects, following the warning that pleadings would be stricken in the event of a failure to comply with the order, the signature of the Judicial Hearing Officer, as well as the signatures of the parties' attorneys. The order thus reflects the explicit agreement and consent of the plaintiff's attorneys to the terms of the order.

By notice dated July 25, 2016, the defendant cross-moved pursuant to CPLR 3126 to strike the complaint based on the plaintiff's failure to comply with the two prior orders directing the plaintiff to respond to the defendant's discovery request and produce the requested documents. In an affirmation of good faith pursuant to 22 NYCRR 202.7, the defendant's attorney affirmed that he had made a good faith effort to resolve the outstanding discovery issues with the plaintiff's attorney, but the plaintiff still had not produced the requested documents. He averred that he had sent a letter to the plaintiff's counsel on November 11, 2015, asking the plaintiff to comply with the November 4, 2015, order to produce the requested documents. The defendant's attorney further averred that on May 31, 2016, he spoke with the plaintiff's attorney and confirmed that the defendant sought production of the documents identified in the defendant's September 17, 2015, discovery request, which had not been produced by the plaintiff despite the November 4, 2015, and May 23, 2016, orders. In the good faith affirmation, the defendant's attorney further stated that, following the May 31, 2016, conversation, the plaintiff had failed to provide the subject documents and, instead, had interposed an objection to the discovery demand. In an affirmation in support of the cross motion, the defendant's attorney elaborated that he had received a letter dated June 9, 2016, from the plaintiff's attorney, which maintained the objection to the discovery demand and to which was attached two documents that were not responsive to the discovery request.

The plaintiff responded to the defendant's cross motion in an attorney affirmation, submitted by an attorney different from the attorney who signed the compliance conference order, in which it was asserted that the plaintiff "maintains that its discovery objections were sufficient," but that the plaintiff had provided the two additional documents in an effort to resolve the dispute. While the plaintiff's counsel argued that the discovery sought by the defendant was irrelevant and speculated that it was unlikely that further responses would produce any additional material, the plaintiff's counsel did not dispute that her firm had, on behalf of the plaintiff, consented to providing the discovery that she was now opposing. This discrepancy was noted in the reply affirmation of the defendant's counsel, who stated that the plaintiff was objecting to discovery demands even though the plaintiff had waived its objections "when its attorney executed the Compliance Conference Order directing plaintiff to produce the documents which plaintiff refuses to produce."

In the order appealed from, dated November 30, 2016, the Supreme Court granted the defendant's cross motion pursuant to CPLR 3126 to strike the complaint and denied the plaintiff's motion for leave to renew its prior motion. The plaintiff appeals from so much of the order as granted the defendant's cross motion. It argues that the Supreme Court should have denied the cross motion because the defendant's attorney's affirmation of good faith was insufficient, the plaintiff made good-faith efforts to comply with the discovery demands, and the discovery sought was not material and necessary. We affirm the order insofar as appealed from.

We begin our analysis with two observations regarding the course that the plaintiff has charted for itself in this action.

First, the plaintiff voluntarily relinquished two opportunities to obtain appellate review of the denials of its efforts to obtain summary judgment. The plaintiff noticed an appeal from the denial of its motion for summary judgment and then failed to perfect the appeal, leading to its dismissal. The plaintiff, having succeeded in obtaining reargument of its summary judgment motion, gained the opportunity to appeal the Supreme Court's adherence to its prior determination to deny summary judgment, but the plaintiff proceeded to withdraw the appeal. Consequently, we can express no opinion on the merits of those putative appeals.

Second, while the plaintiff timely interposed objections to the defendant's discovery demands, the plaintiff voluntarily abandoned those objections when it entered into the compliance conference order in which it agreed to comply with the discovery demands notwithstanding its prior objections. It is axiomatic that a party who consents to an order cannot be considered aggrieved by it (see Matter of Harry Y., 62 AD3d 892). While there may be at least potential merit to the plaintiff's contentions that the defendant's discovery demands were overbroad, the plaintiff now cannot be heard to complain about having to comply with discovery demands which it affirmatively consented to with knowledge that unjustified noncompliance would render its pleading subject to dismissal.

Although actions should be resolved on the merits when possible (see Cruzatti v St. Mary's Hosp., 193 AD2d 579, 580), a court may strike "pleadings or parts thereof" (CPLR 3126[3]) as a sanction against a party who "refuses to obey an order for disclosure or wilfully fails to disclose information which the court finds ought to have been disclosed" (CPLR 3126). "The willful or contumacious character of a party's conduct can be inferred from the party's repeated failure to respond to demands or to comply with discovery orders, and the absence of any reasonable excuse for these failures" (Smookler v Dicerbo, 166 AD3d 838, 839; see Montemurro v Memorial Sloan-Kettering Cancer Ctr., 94 AD3d 1066; Tos v Jackson Hgts. Care Ctr., LLC, 91 AD3d 943, 943-944). The nature and degree of the sanction to be imposed on a motion pursuant to CPLR 3126 is a matter of discretion with the motion court (see Merrill Lynch, Pierce, Fenner & Smith, Inc. v Global Strat Inc., 22 NY3d 877, 880; Those Certain Underwriters at Lloyds, London v Occidental Gems, Inc., 11 NY3d 843, 845; Sepulveda v 101 Woodruff Ave. Owner, LLC, 166 AD3d 835, 836; Silberstein v Maimonides Med. Ctr., 109 AD3d 812, 814). "[W]hen a party fails to comply with a court order and frustrates the disclosure scheme set forth in the CPLR, it is well within the Trial Judge's discretion to dismiss the complaint" (Kihl v Pfeffer, 94 NY2d 118, 122; see Zletz v Wetanson, 67 NY2d 711, 713).

Contrary to the plaintiff's contention, the Supreme Court did not improvidently exercise its discretion in granting the defendant's cross motion to strike the complaint. The willful or contumacious character of the plaintiff's conduct could be properly inferred from the repeated failures to comply with the court's orders directing the plaintiff to respond to the defendant's discovery request, the plaintiff's consent to produce the requested documents, and the plaintiff's lack of an adequate explanation for the failure to comply (see Smookler v Dicerbo, 166 AD3d at 839-840; Montemurro v Memorial Sloan-Kettering Cancer Ctr., 94 AD3d 1066; Tos v Jackson Hgts. Care Ctr., LLC, 91 AD3d at 944). In opposition to the defendant's cross motion, the plaintiff did not assert that it had even attempted to locate the subject documents. Instead, the plaintiff's counsel offered only her speculation that it was highly unlikely that additional documents would have been produced.

The plaintiff's contention that the requested documents were not material and necessary is unavailing. The plaintiff did not pursue appeals from the June 4, 2014, and March 11, 2015, orders, which determined that further documentation was necessary. The plaintiff was then directed to disclose the subject documents in two court orders, the second of which was entered on the plaintiff's consent, and which contained a warning in bold font that the failure to comply with the terms of the order "will result in the striking of a pleading." The plaintiff did not seek to be relieved of its consent to this order; in its opposition to the defendant's cross motion, the plaintiff argued that the subject discovery should not be provided, completely ignoring the plaintiff's consent to provide that very discovery.

"If the credibility of court orders and the integrity of our judicial system are to be maintained, a litigant cannot ignore court orders with impunity" (Kihl v Pfeffer, 94 NY2d at 123; see Gibbs v St. Barnabas Hosp., 16 NY3d 74, 81). "[C]ompliance with a disclosure order requires both a timely response and one that evinces a good-faith effort to address the requests meaningfully" (Kihl v Pfeffer, 94 NY2d at 123; see CDR Créances S.A.S. v Cohen, 23 NY3d 307, 318). This is particularly true where the discovery at issue was consented to. If the plaintiff believed that the requested documents were not material and necessary, it should have pursued its appeals of the Supreme Court's prior orders. Instead, it consented to an order directing it to produce the requested [*3]documents with a warning that the pleadings would be stricken upon failure to comply with the order.

Under these unique circumstances, we cannot say that the Supreme Court's determination to strike the pleadings was an improvident exercise of discretion (see CDR Créances S.A.S. v Cohen, 23 NY3d at 318; Kihl v Pfeffer, 94 NY2d at 123; Smookler v Dicerbo, 166 AD3d 838, 839).

Also contrary to the plaintiff's contention, the cross motion was not deficient on the ground that the defendant did not comply with 22 NYCRR 202.7. The cross motion was supported by the affirmation of the attorney for the defendant, which contained an adequate statement explaining his good-faith efforts to resolve the issues raised by the motion (see 22 NYCRR 202.7; Maliah-Dupass v Dupass, 166 AD3d 873, 874; Giordano v Giordano, 140 AD3d 699, 700)."

Labels:

CPLR 3216,

Discovery,

LITIGATION

Monday, December 2, 2019

MORTGAGE FORECLOSURE - A SUCCESSFUL STANDING DEFENSE

HSBC Bank USA, N.A. v Williams, 2019 NY Slip Op 08554, Decided on November 27, 2019, Appellate Division, Second Department:

"On December 21, 2004, the defendant Kirk Williams executed a note in the amount of $399,000 in favor of Fremont Investment & Loan (hereinafter Fremont) and a mortgage in favor of Mortgage Electronic Registration Systems, Inc., as nominee for Fremont. Williams defaulted on the note by failing to make the payment due on April 1, 2009. On November 2, 2009, the plaintiff commenced this action to foreclose the mortgage. On March 23, 2010, and June 18, 2010, respectively, the plaintiff obtained an order of reference and a judgment of foreclosure and sale, on [*2]default. On October 13, 2010, the order of reference and the judgment of foreclosure and sale were vacated. On November 9, 2010, Williams served an amended answer dated October 27, 2010, in which he generally denied the allegations of the complaint and asserted six affirmative defenses, including lack of standing.

On June 18, 2015, Williams filed and served a "Demand for Resumption of Prosecution of Action and For Note of Issue." When the plaintiff failed to comply, Williams moved pursuant to CPLR 3216 to dismiss the complaint insofar as asserted against him. The plaintiff opposed the motion and cross-moved, inter alia, for summary judgment on the complaint insofar as asserted against Williams, to strike his affirmative defenses, and for an order of reference. The plaintiff asserted that it had a justifiable excuse for not proceeding with the action and a potentially meritorious cause of action. The Supreme Court, among other things, denied Williams's motion and granted those branches of the plaintiff's cross motion. Williams appeals.

Where, as here, a plaintiff has been served with a 90-day demand pursuant to CPLR 3216(b)(3), that plaintiff must comply with the demand by filing a note of issue or by moving, before the default date, either to vacate the demand or to extend the 90-day period (see Deutsche Bank Natl. Trust Co. v Inga, 156 AD3d 760). The plaintiff here failed to do either within the 90-day period. Therefore, in order to excuse the default, the plaintiff was obliged to demonstrate a justifiable excuse for its failure to take timely action in response to the 90-day demand, as well as a potentially meritorious cause of action (see Baczkowski v Collins Constr. Co., 89 NY2d 499; Bischoff v Hoffman, 112 AD3d 659). CPLR 3216 is "extremely forgiving" (Baczkowski v Collins Constr. Co., 89 NY2d at 503), "in that it never requires, but merely authorizes, the Supreme Court to dismiss a plaintiff's action based on the plaintiff's unreasonable neglect to proceed" (Davis v Goodsell, 6 AD3d 382, 384; see Angamarca v 47-51 Bridge St. Prop., LLC, 167 AD3d 559; Deutsche Bank Natl. Trust Co. v Inga, 156 AD3d at 761).

Here, the plaintiff demonstrated the existence of a justifiable excuse for the delay and a potentially meritorious cause of action. Furthermore, there was no evidence of its intent to abandon the action (see generally Angamarca v 47-51 Bridge St. Prop., LLC, 167 AD3d at 559; Vera v New York El. & Elec. Corp., 150 AD3d 927; Altman v Donnenfeld, 119 AD3d 828). Under the circumstances of this case, the Supreme Court providently exercised its discretion in denying Williams's motion pursuant to CPLR 3216 to dismiss the complaint insofar as asserted against him.

In moving for summary judgment, a plaintiff in a mortgage foreclosure action establishes its prima facie entitlement to judgment as a matter of law by producing the mortgage, the unpaid note, and evidence of the default (see James B. Nutter & Co. v Feintuch, 164 AD3d 485, 486; Onewest Bank, N.A. v Mahoney, 154 AD3d 770, 771; Deutsche Bank Trust Co. Ams. v Garrison, 147 AD3d 725, 726). In addition, where, as here, a plaintiff's standing to commence the foreclosure action is placed in issue by the defendant, it is incumbent upon the plaintiff to prove its standing to be entitled to relief (see Deutsche Bank Natl. Trust Co. v Brewton, 142 AD3d 683, 684; Wells Fargo Bank, N.A. v Arias, 121 AD3d 973, 974).

"A plaintiff establishes its standing in a mortgage foreclosure action by demonstrating that, when the action was commenced, it was either the holder or assignee of the underlying note" (Dyer Trust 2012-1 v Global World Realty, Inc., 140 AD3d 827, 828; see Aurora Loan Servs., LLC v Taylor, 25 NY3d 355, 360-362; Flagstar Bank, FSB v Mendoza, 139 AD3d 898, 899). "Either a written assignment of the underlying note or the physical delivery of the note prior to the commencement of the foreclosure action is sufficient to transfer the obligation, and the mortgage passes with the debt as an inseparable incident" (Dyer Trust 2012-1 v Global World Realty, Inc., 140 AD3d at 828; see Aurora Loan Servs., LLC v Taylor, 25 NY3d at 361-362; U.S. Bank, N.A. v Collymore, 68 AD3d 752, 754). The plaintiff may establish that it was the holder of the note at the time the action was commenced by submitting proof that a copy of the note, including an allonge containing an endorsement in blank, was among the various exhibits annexed to the complaint (see UCC 1-201[b][21]; Bank of Am., N.A. v Tobin, 168 AD3d 661; CitiMortgage, Inc. v McKenzie, 161 AD3d 1040, 1041).

In support of its cross motion, the plaintiff failed to meet its prima facie burden of establishing that it had standing to commence this action. Initially, while the plaintiff alleged that the note had been endorsed to it, the plaintiff failed to submit sufficient evidence to demonstrate that a copy of the note with the endorsement was attached to the complaint. The only copy of the complaint that appears in the record before us was submitted as an exhibit in support of Williams's motion, and the version of the note accompanying that copy of the complaint did not include the endorsement. The plaintiff's attempt to establish standing through the submission of the affidavit of Morgan Battle Ames, a contract management coordinator for the plaintiff's loan servicer, was also insufficient. Ames stated that she had "personal knowledge of the stated facts and circumstances and books and records maintained by [the loan servicer]," and that the "information in this affidavit is taken from [the loan servicer's] business records," which were "recorded by persons with personal knowledge of the information in the business record." Since Ames failed to attest that she was personally familiar with the record-keeping practices and procedures of the entity that generated the subject business records, she failed to demonstrate that the records relied upon in her affidavit were admissible under the business records exception to the hearsay rule (see CPLR 4518[a]; Federal Natl. Mtge. Assn. v Marlin, 168 AD3d 679, 681; HSBC Mtge. Servs., Inc. v Royal, 142 AD3d 952, 954; Deutsche Bank Natl. Trust Co. v Brewton, 142 AD3d at 685).

Since the plaintiff's cross motion was based on evidence that was not in admissible form (see Federal Natl. Mtge. Assn. v Marlin, 168 AD3d at 681; HSBC Mtge. Servs., Inc. v Royal, 142 AD3d at 954), the Supreme Court should have denied those branches of the cross motion which were for summary judgment on the complaint insofar as asserted against Williams, to strike his affirmative defenses, and for an order of reference, regardless of the sufficiency of the evidence submitted by Williams in opposition (see Winegrad v New York Univ. Med. Ctr., 64 NY2d 851, 853)."

Labels:

CPLR 3216,

Mortgage Foreclosure,

Standing

Wednesday, November 27, 2019

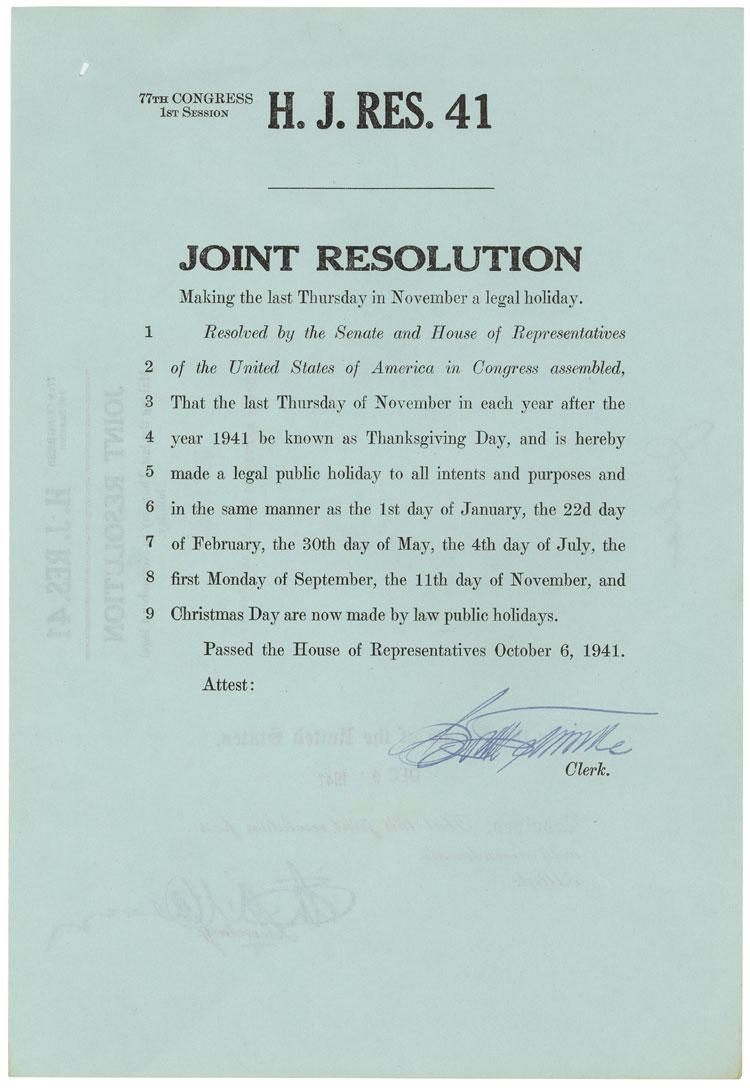

FOR THE HOLIDAY

"On October 6, 1941, the House passed a joint resolution declaring the

last Thursday in November to be the legal Thanksgiving Day. The Senate,

however, amended the resolution establishing the holiday as the fourth

Thursday, which would take into account those years when November has

five Thursdays. The House agreed to the amendment, and President

Roosevelt signed the resolution on December 26, 1941, thus establishing

the fourth Thursday in November as the Federal Thanksgiving Day holiday."

Tuesday, November 26, 2019

YELLOWSTONE, IF NOT WAIVED, STILL LIVES

Although the right to bring a Yellowstone injunction can be waived (159 MP Corp. v Redbridge Bedford, LLC 2019, NY Slip Op 03526, Decided on May 7, 2019 ,Court of Appeals DiFiore, J.), in this case, there was no waiver.

456 Johnson, LLC v Maki Realty Corp., 2019 NY Slip Op 08384, Decided on November 20, 2019, Appellate Division, Second Department:

"In April 2015, the defendant landlord, Maki Realty Corp., entered into a commercial lease with the plaintiff tenant, 456 Johnson, LLC, relating to certain real property located in Brooklyn. On or about April 28, 2016, the defendant served the plaintiff with a "Thirty (30) Day Notice to Cure" (hereinafter notice to cure), alleging several violations of the lease. The defendant demanded that the plaintiff cure all the violations listed in the notice to cure on or before May 31, 2016, and stated that if the violations were not cured by that date, the defendant would elect to terminate the lease.

On May 17, 2016, the plaintiff commenced this action, inter alia, to enjoin the defendant from terminating the lease and for a judgment declaring that it did not breach the terms of the lease as alleged in the notice to cure, and simultaneously moved by order to show cause for [*2]a Yellowstone injunction (see First Natl. Stores v Yellowstone Shopping Ctr., 21 NY2d 630) enjoining the defendant from terminating the lease pending resolution of the action. In an order dated August 5, 2016, the Supreme Court granted the plaintiff's motion for a Yellowstone injunction on the condition that it, inter alia, pay real estate taxes in compliance with the lease.

The defendant then moved for summary judgment dismissing the complaint, and the plaintiff cross-moved for summary judgment, inter alia, on so much of its first cause of action as was for a judgment declaring that it did not breach the lease. The defendant also separately moved, inter alia, to vacate the Yellowstone injunction. The Supreme Court conditionally granted that branch of the defendant's motion which was to vacate the Yellowstone injunction, denied the defendant's motion for summary judgment dismissing the complaint, and granted the subject branch of the plaintiff's cross motion.

"A motion to vacate or modify a preliminary injunction is addressed to the sound discretion of the court and may be granted upon compelling or changed circumstances that render continuation of the injunction inequitable'" (Thompson v 76 Corp., 37 AD3d 450, 452-453, quoting Wellbilt Equip. Corp. v. Red Eye Grill, 308 AD2d 411, 411). In this case, the defendant failed to demonstrate that the Supreme Court's conditional granting of that branch of its motion which was to vacate the Yellowstone injunction was an abuse of discretion (see Town of Stanford v Donnelly, 131 AD2d 465). Accordingly, we agree with the court's determination conditionally granting that branch of the defendant's motion which was to vacate the Yellowstone injunction.

We also agree with the Supreme Court's determination denying the defendant's motion for summary judgment dismissing the complaint, and granting the plaintiff's cross motion for summary judgment, inter alia, on so much of its first cause of action as was for a judgment declaring that it did not breach the lease. In support of its cross motion for summary judgment, the plaintiff submitted evidence establishing, prima facie, that it either did not breach the terms of the lease as alleged in the notice to cure or that it cured any alleged default in complying with the lease during the pendency of the Yellowstone injunction (see Graubard Mollen Horowitz Pomeranz & Shapiro v 600 Third Ave. Assoc., 93 NY2d 508, 514; Barsyl Supermarkets, Inc. v Avenue P Assoc., LLC, 86 AD3d 545). In opposition to the plaintiff's showing in this regard, the defendant failed to raise a triable issue of fact.

Since this is, in part, a declaratory judgment action, we remit the matter to the Supreme Court, Kings County, for the entry of a judgment, inter alia, declaring that there was no uncured breach of the lease by the plaintiff (see Lanza v Wagner, 11 NY2d 317, 334)."

Monday, November 25, 2019

Friday, November 22, 2019

NEIGHBOR'S DISPUTE ON WATER RUNOFF BARRED BY STATUTE OF LIMITATIONS

Perhaps he could have resolved this earlier.

Ubiles v. Ngardingabe, NYLJ November 21, 2019, Date filed: 2019-10-31, Court: Supreme Court, New York, Judge: Justice Arlene Bluth. Case Number: 151439/2017:

"Plaintiffs and defendants are neighbors and they own adjoining properties on West 147th Street in Manhattan. Plaintiffs claim that rain water and snow melt flows from defendants’ driveway into plaintiffs’ property. Plaintiffs contend that as a result of this runoff, the foundation and the walls of their home have been damaged. They contend that defendants caused this condition by impermissibly altering the water drainage system in defendants’ driveway and defendants have done nothing to remediate the problem despite plaintiffs’ complaints

Defendants move to dismiss based on the statute of limitations and on plaintiffs’ failure to state a cause of action. Defendants claim that the driveway was installed in 1989 when two lots (431 and 433 West 147th Street) were merged. Defendants argue that the driveway is pitched towards the street and is not causing damage to plaintiffs’ property. Defendants claim that in 2006, plaintiffs requested permission from defendants to access defendants’ driveway to do pointing work and partial waterproofing on plaintiffs’ wall. Defendants contend that by 2009, the work on plaintiffs’ wall was deteriorating and rendered the property vulnerable to damage from rain and snow.

In 2014, plaintiffs again requested access to defendants’ property and defendants insist they allowed plaintiffs to install a tarp over a portion of the subject wall. In May 2015, defendants received a letter from plaintiffs’ attorney arguing that defendants’ actions in 2009 or 2010 (cementing over the existing driveway) were deficient and caused the surface to pitch towards plaintiffs’ property. Defendants admit that the driveway was paved in 2009.

Defendants also point out that they notified their insurance company after receiving this letter from plaintiffs’ counsel but that their insurance company found that the driveway did not contribute to plaintiffs’ damage. Defendants maintain that plaintiffs reached out to plaintiffs’ insurance carrier, who also denied plaintiffs’ claim based on the water runoff.

Defendants argue that this case is time-barred because the driveway was altered, at the latest, eight years before this action was commenced. Defendants also argue that the continuous wrong doctrine does not apply because the damage arises out of a single allegedly objectionable act (the altering of the driveway). Defendants conclude that plaintiffs knew about the damage since at least 2006 and, therefore, they cannot claim a continuing trespass or nuisance.

In opposition, plaintiffs insist they did not know about the source of the water flow until 2015. Plaintiffs purportedly hired an architect in 2015, who found that the water was flowing from defendants’ driveway. Plaintiffs argue that defendants expanded their driveway without the proper approval from the city. Plaintiffs dispute that they knew about the water damage in 2006 even though they claim that every time it rains or snows, their property is inundated with water runoff. Plaintiffs conclude that the water runoff constitutes a trespass to their property.

Discussion

“In moving to dismiss an action as barred by the statute of limitations, the defendant bears the initial burden of demonstrating, prima facie, that the time within which to commence the cause of action has expired. The burden then shifts to the plaintiff to raise a question of fact as to whether the statute of limitations is inapplicable or whether the action was commenced within the statutory period, and the plaintiff must aver evidentiary facts establishing that the action was timely or [] raise an issue of fact as to whether the action was timely” (MTGLQ Investors, LP v. Wozencraft, 2019 WL 2291865, 2019 NY Slip Op 04287 [1st Dept 2019] [internal quotations and citations omitted]).

“The continuous wrong doctrine is an exception to the general rule that the statute of limitations runs from the time of the breach though no damage occurs until later. The doctrine is usually employed where there is a series of continuing wrongs and serves to toll the running of a period of limitations to the date of the commission of the last wrongful act. Where applicable, the doctrine will save all claims for recovery of damages but only to the extent of wrongs committed within the applicable statute of limitations. The doctrine may only be predicated on continuing unlawful acts and not on the continuing effects of earlier unlawful conduct. The distinction is between a single wrong that has continuing effects and a series of independent, distinct wrongs. The doctrine is inapplicable where there is one tortious act complained of since the cause of action accrues in those cases at the time that the wrongful act first injured plaintiff and it does not change as a result of continuing consequential damages” (Henry v. Bank of America, 147 AD3d 599, 601 48 NYS3d 67 [1st Dept 2017] [internal quotations and citations omitted]).

Here, the Court finds that the instant action is barred by the statute of limitations. This case was filed in 2017. The allegedly unlawful acts were either the construction of the driveway in 1989 or the paving of the driveway in 2009. Both of these acts (which purportedly caused the water runoff) occurred prior to the three-year statute of limitations applicable to plaintiffs’ causes of action. Plaintiffs do not allege that defendants did anything else to cause the water runoff. Therefore, the Court finds that, assuming plaintiffs’ claims are true, the paving of the driveway in 2009 was a single and distinct wrong that has had purportedly continuing effects rather than a series of independent acts. Put another way, because defendants have not altered the driveway since 2009, the water runoff when it rains or snows are not new wrongful acts by defendants.

Moreover, the record shows plaintiffs were experiencing water runoff problems since at least 2006. The letter correspondence between the parties makes clear that plaintiffs needed to have work done to keep their basement dry (NYSCEF Doc. No. 78). In fact, the parties’ communications show that a wall was built by plaintiffs in 2006 for “drainage enhancement” (id.). In other words, plaintiffs clearly had water problems in 2006 and took actions to try and remediate the problem more than three years before they brought this action.

The opposition, an affidavit from plaintiff Joseph Ubiles, conveniently skips from a conclusory assertion that defendants’ driveway had nothing to do with the 2006 work to 2015 (NYSCEF Doc. No. 86,10-15). There is no explanation for why they did not seek to discover the cause of the water issues in 2006 despite the fact that they needed access to defendants’ property to do the work. And that work involved the construction of a wall that defendants’ claim was impermissibly built on their property. That plaintiffs waited until 2015 to hire an architect, who claims that the water runoff was from defendants’ driveway, does not extend the statute of limitations. Plaintiffs cannot sit on their rights for over a decade after their property suffered water damage. Therefore, plaintiffs’ claims are untimely (see Alamio v. Town of Rockland, 302 AD2d 842, 755 NYS2d 754 [3d Dept 2003] [finding that continuing trespass and nuisance claims arising out of water runoff from an adjacent parking lot were time-barred because the damage was apparent more than three years prior to the commencement of the action]).:

In 2014, plaintiffs again requested access to defendants’ property and defendants insist they allowed plaintiffs to install a tarp over a portion of the subject wall. In May 2015, defendants received a letter from plaintiffs’ attorney arguing that defendants’ actions in 2009 or 2010 (cementing over the existing driveway) were deficient and caused the surface to pitch towards plaintiffs’ property. Defendants admit that the driveway was paved in 2009.

Defendants also point out that they notified their insurance company after receiving this letter from plaintiffs’ counsel but that their insurance company found that the driveway did not contribute to plaintiffs’ damage. Defendants maintain that plaintiffs reached out to plaintiffs’ insurance carrier, who also denied plaintiffs’ claim based on the water runoff.

Defendants argue that this case is time-barred because the driveway was altered, at the latest, eight years before this action was commenced. Defendants also argue that the continuous wrong doctrine does not apply because the damage arises out of a single allegedly objectionable act (the altering of the driveway). Defendants conclude that plaintiffs knew about the damage since at least 2006 and, therefore, they cannot claim a continuing trespass or nuisance.

In opposition, plaintiffs insist they did not know about the source of the water flow until 2015. Plaintiffs purportedly hired an architect in 2015, who found that the water was flowing from defendants’ driveway. Plaintiffs argue that defendants expanded their driveway without the proper approval from the city. Plaintiffs dispute that they knew about the water damage in 2006 even though they claim that every time it rains or snows, their property is inundated with water runoff. Plaintiffs conclude that the water runoff constitutes a trespass to their property.

Discussion