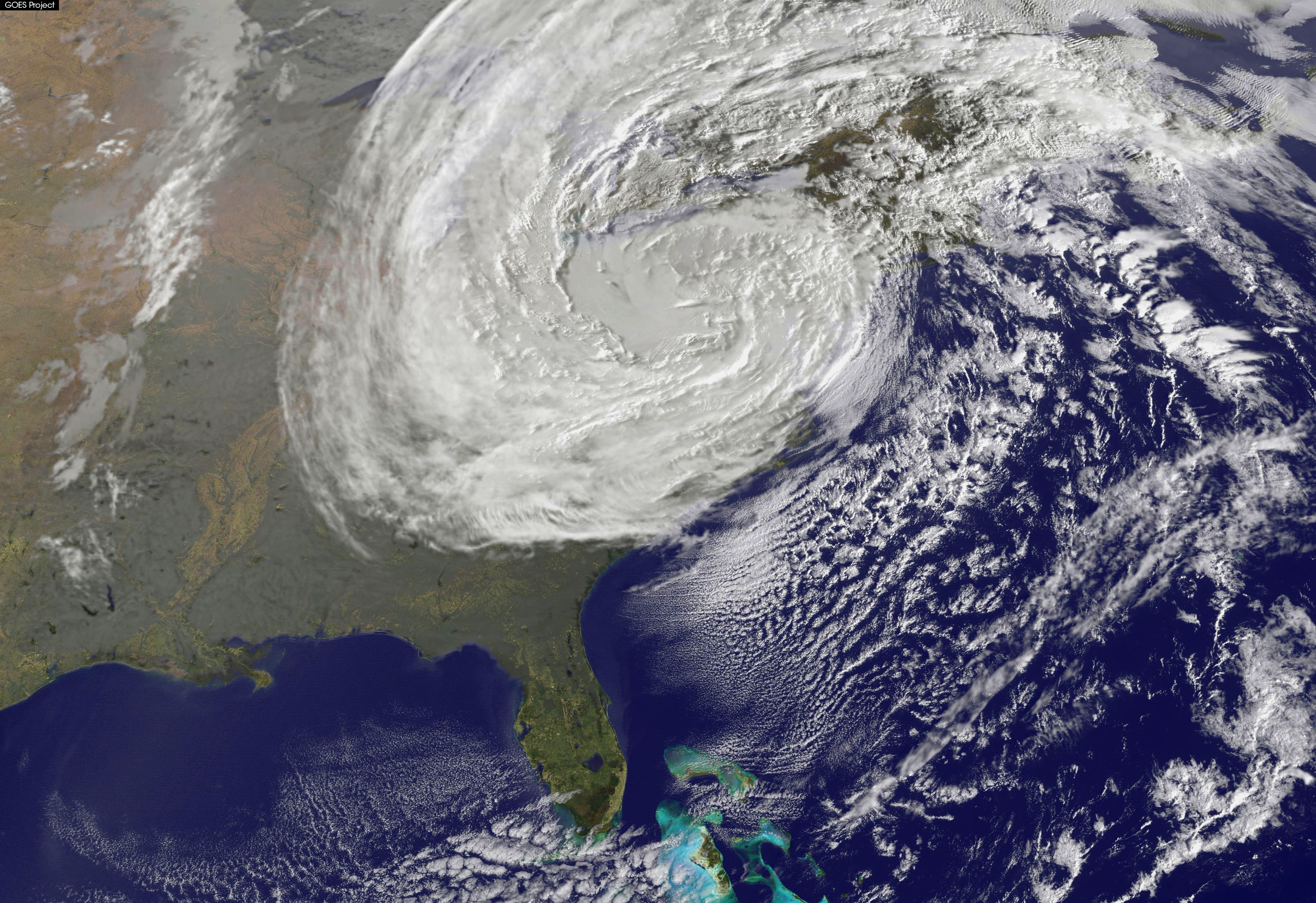

6 1/2 years after Superstorm Sandy and litigations still exist; in this matter, a new trial was ordered.

Greenberg v Privilege Underwriters Reciprocal Exch., 2019 NY Slip Op 01202, Decided on February 20, 2019, Appellate Division, Second Department:

"The plaintiffs' home, located in the Bergen Beach area of Brooklyn, was damaged in late October 2012 during Hurricane Sandy. The plaintiffs' basement was flooded and, according to the plaintiffs, other areas of the home also sustained water damage. The plaintiffs' homeowners' insurance policy, issued by the defendant, insured against "all risks of sudden and accidental direct physical loss or damage to [the] dwelling . . . unless an exclusion applies." The policy provided additional coverage for loss or damage caused by "[w]ater which backs up through sewers or drains," or "[w]ater which overflows from a sump even if such overflow results from the mechanical breakdown of the sump pump." However, the policy excluded from coverage "any loss by surface or ground water," defined as "[f]lood, surface water, waves, tidal water, overflow of a body of water, or spray from any of these, whether or not driven by wind."

The plaintiffs commenced this action, inter alia, to recover damages for the defendant's alleged breach of the policy for failing to provide coverage for the damage to their home. At trial, the primary issue was whether the water damage to the plaintiffs' home was covered or excluded by the policy. The plaintiffs presented evidence that the flooding of the basement and water damage to the other areas of their home resulted from a pressurized back up of the sewer system. In contrast, the defendant presented evidence that the flooding of the basement and other claimed losses were caused by groundwater and tidal flooding.

Over the defendant's objection, the Supreme Court instructed the jury that if the [*2]plaintiffs' home "was damaged by two or more conditions or events, any one of which is covered under the insurance policy . . . then [the defendant] may be liable if . . . the conditions or events acted together to cause the damage to the [plaintiffs'] home." The jury returned a verdict in favor of the plaintiffs and against the defendant, awarding damages in the principal sum of $1,875,386.92. The defendant appeals. We reverse and grant a new trial.

"A trial court is required to state the law relevant to the particular facts in issue, and a set of instructions that confuses or incompletely conveys the germane legal principles to be applied in a case requires a new trial" (J.R. Loftus, Inc. v White, 85 NY2d 874, 876). Under an all-risk property damage policy, where multiple perils work together to cause the same loss, and one or more of those perils is covered under the policy, New York follows the majority rule such that the loss will be covered if the "proximate, efficient and dominant cause" of the loss is covered by the policy (Album Realty Corp. v American Home Assur. Co., 80 NY2d 1008, 1010; see Neuman v United Servs. Auto. Assn., 74 AD3d 925, 926; Kannatt v Valley Forge Ins. Co., 228 AD2d 564, 564-565; see also 5 New Appleman on Insurance Law Library Edition § 44.03[5] [2018]). By contrast, a minority of jurisdictions adhere to the broader "concurrent cause" rule, under which a loss will be covered "if any one of multiple non-remote causes of the same loss is a non-excluded peril" (5 New Appleman on Insurance Law Library Edition § 44.03[3] [2018]).

Here, the Supreme Court's instruction to the jury misstated the law in that it permitted the jury to find coverage for the plaintiffs' loss if one or more covered perils acted together with a noncovered peril to cause the same loss, without regard to whether the efficient or dominant cause of the loss was a covered peril under the policy. Since the error may have prejudiced the defendant, a new trial is warranted (see Rakoff v New York City Dept. of Educ., 110 AD3d 780, 781; see also J.R. Loftus, Inc. v White, 85 NY2d at 876; Moore v New York El. R.R. Co., 130 NY 523, 529). The Supreme Court's instruction to the jury, in effect, that the exclusion for losses caused by surface or ground water was ambiguous, was also erroneous (see Platek v Town of Hamburg, 24 NY3d 688, 697; see also White v Continental Cas. Co., 9 NY3d 264, 267; Cali v Merrimack Mut. Fire Ins. Co., 43 AD3d 415, 417).

We agree with the Supreme Court's determination to permit one of the plaintiffs' expert witnesses to testify regarding the necessity and reasonable costs associated with demolishing and rebuilding of the plaintiffs' home (see De Long v County of Erie, 60 NY2d 296, 307; Felicia v Boro Crescent Corp., 105 AD3d 697, 698; Formica v Formica, 101 AD3d 805, 806)."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.