C.C. v. R.C., Date filed: 2022-01-10, Court: Supreme Court, Richmond, Judge: Justice Ralph Porzio, Case Number: 55103/2020:

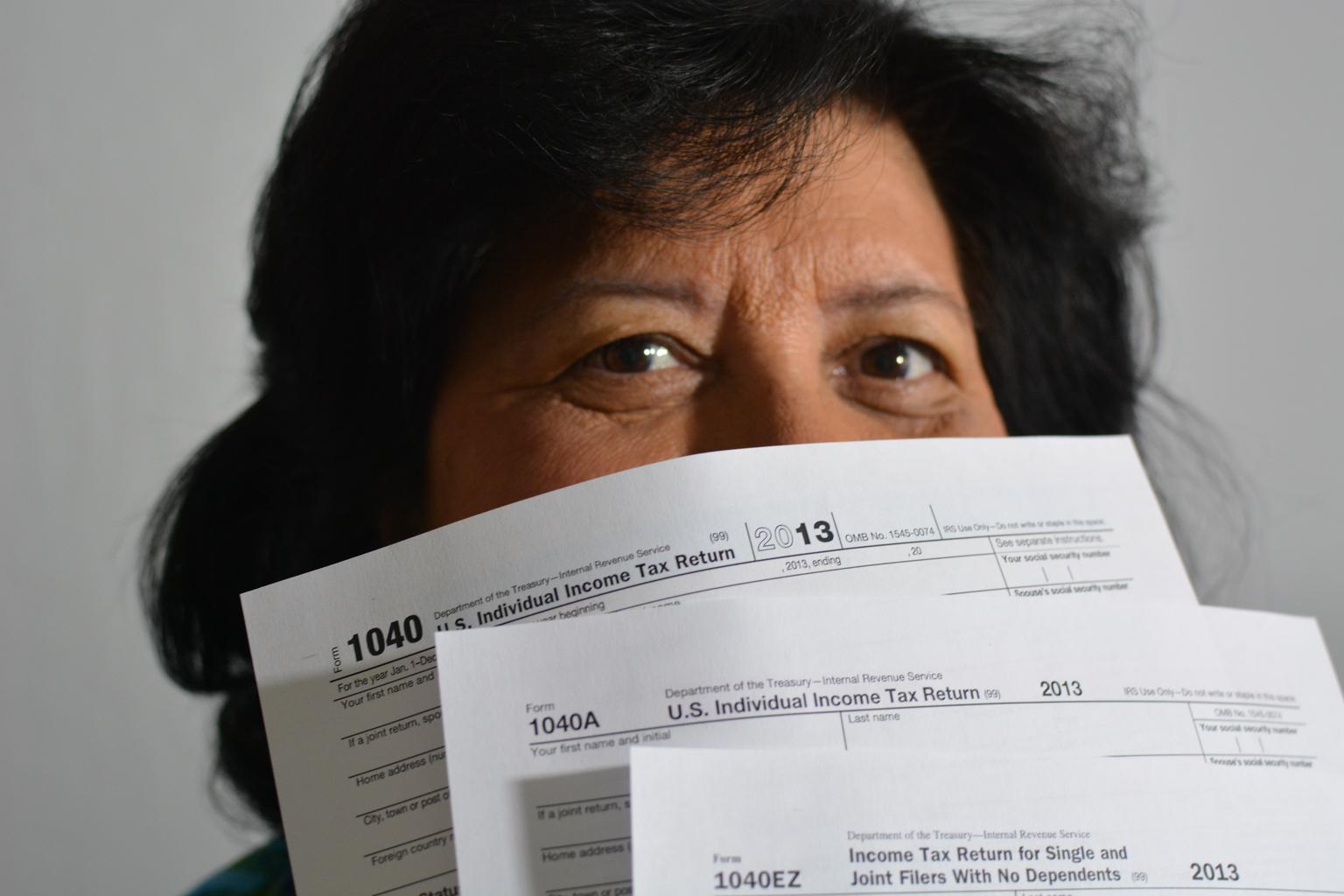

"...During most of the marriage, the Defendant was the sole income earner. The Plaintiff and Defendant filed joint taxes throughout the marriage; however, they failed to report and pay state and federal taxes for a number of years. This failure has resulted in hundreds of thousands of dollars being owed, fees and interest being assessed, and liens being placed on the marital residence. At the time of trial, the balance due on federal and state taxes is approximately $700,000 per the parties’ testimony.

The Plaintiff alleges that this tax debt is a wasteful dissipation of marital assets. The Plaintiff testified that during the marriage the parties filed joint taxes, that she signed the joint tax returns, and that she acknowledged that the tax liabilities owed to the IRS and the State of NY are owed by her and the Defendant. Notably, despite this crippling debt held by the parties, the Plaintiff never filed for innocent spouse status with the IRS and neither party has filed for bankruptcy. The Defendant acknowledged the debt but as he stated, the parties were “encouraged just to keep spending money, sometimes not even care about the credit card bills.” See Transcript dated 8/30/2021, page 38. During the trial, both parties admitted to being convicted of falsifying business records in order to obtain Medicare coverage during the marriage. The Court finds this information persuasive regarding their combined financial history.

As the Plaintiff has shared in the benefits derived from the parties’ failure to pay their taxes, she must also share in the financial liability arising out of tax liability. See Conway v. Conway, 29 AD3d 725, [2d Dept. 2006]. Based upon the foregoing, considering the equitable distribution factors, wasteful dissipation, the credibility of the parties, and the testimony of the Plaintiff’s expert, Richard Gabor, the Court finds that the IRS federal tax debt and the New York State tax debt is the responsibility of both parties, jointly and severally, and this Court will not apportion liability to one party over the other."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.